Films are an important source of entertainment in the Middle East, and Arab nationals are increasingly watching films via multiple channels, including on TV, online, and in the cinema. As in 2014 and 2016, nearly all nationals watch films on TV (91% in 2014, 90% in 2016, 90% in 2018). Since 2014, though, film viewing on the internet increased by 21 percentage points (42% in 2014 vs. 50% in 2016 vs. 63% in 2018), and cinema attendance increased by 9 points (33% in 2014 vs. 36% in 2016 vs. 42%% in 2018).

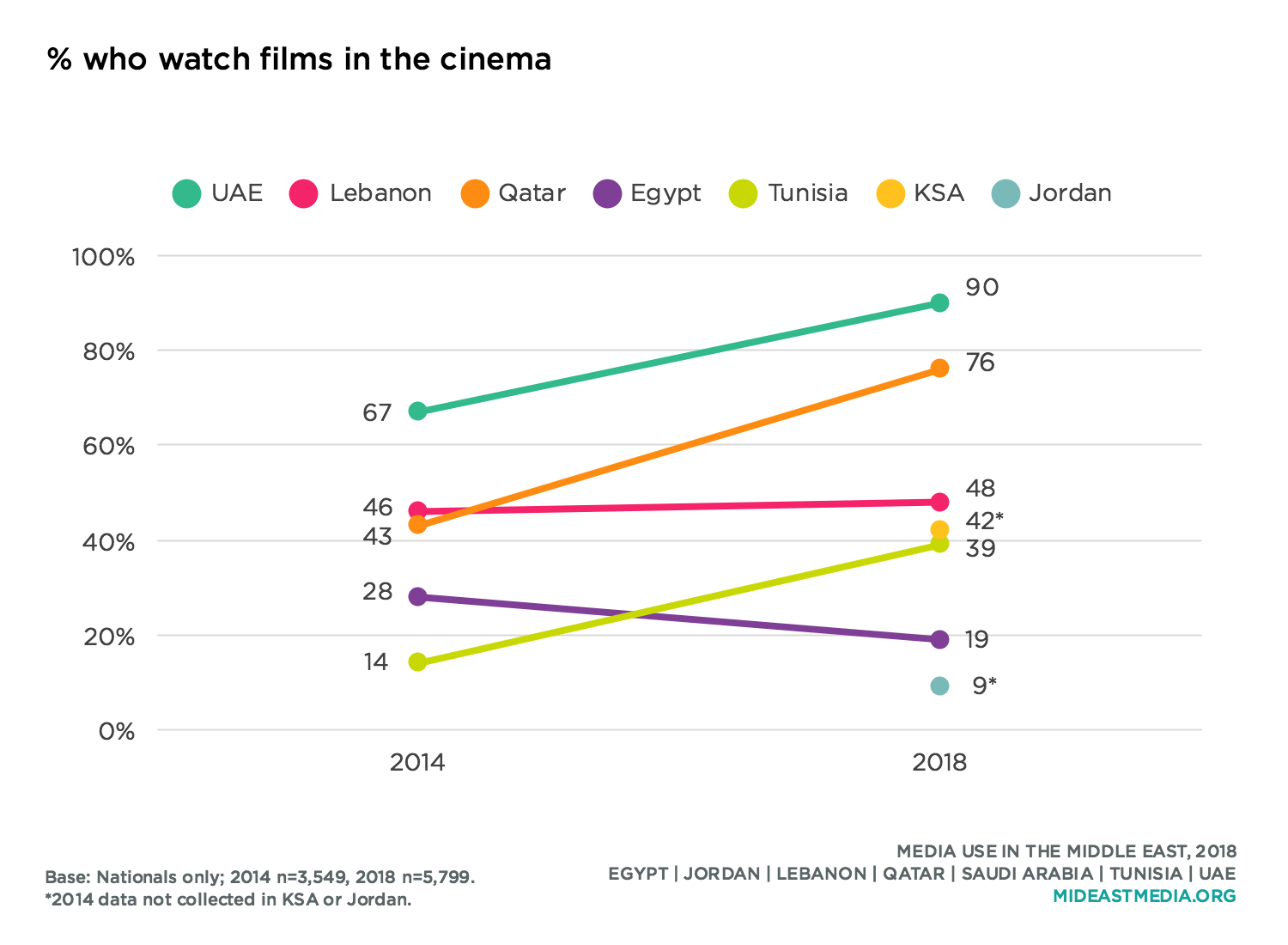

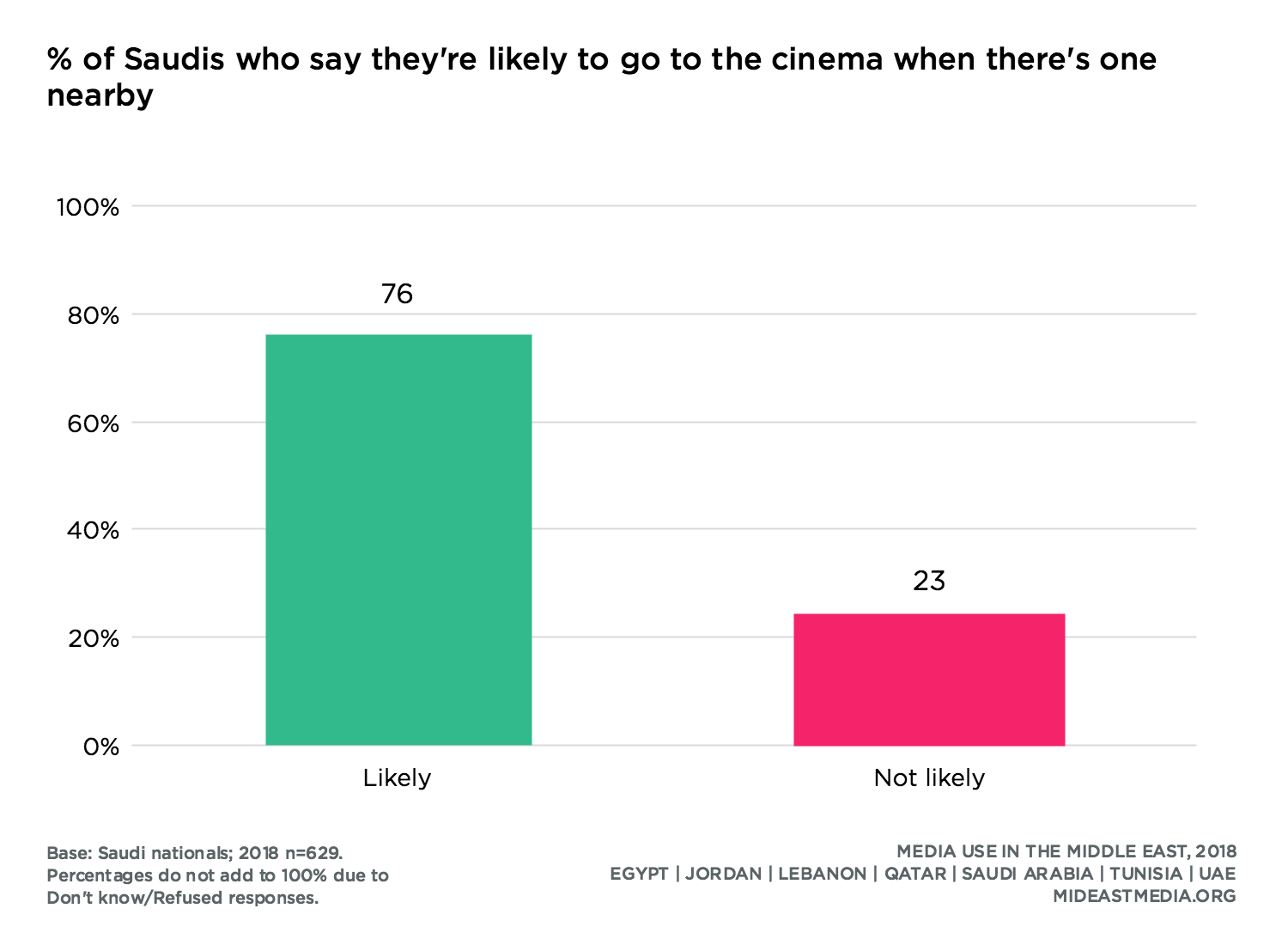

An increase in online viewing and cinema attendance was observed in all surveyed countries, except in Egypt where film viewership online remained stable since 2014 and cinema attendance decreased. Cinema attendance is particularly high in the UAE and Qatar, as more than half of Emiratis and Qataris go to the cinema at least once a month (59% and 55%, respectively). Now that cinemas have reopened in Saudi Arabia, four in 10 Saudis say they go to the cinema and three-quarters are likely to do so in future. Nationals in Jordan and Egypt report the lowest cinema attendance.

Men and women are equally likely to attend the cinema (38% men, 34% women), and nationals of all ages attend the cinema in similar proportions, apart from those 45 and older who are less inclined to attend (45% 18-24 year-olds, 42% 25-34 year-olds, 36% 35-44 year-olds vs. 21% 45+ year-olds). Education seems strongly and positively associated with moviegoing (13% primary or less, 23% intermediate, 38% secondary, 52% university or higher).

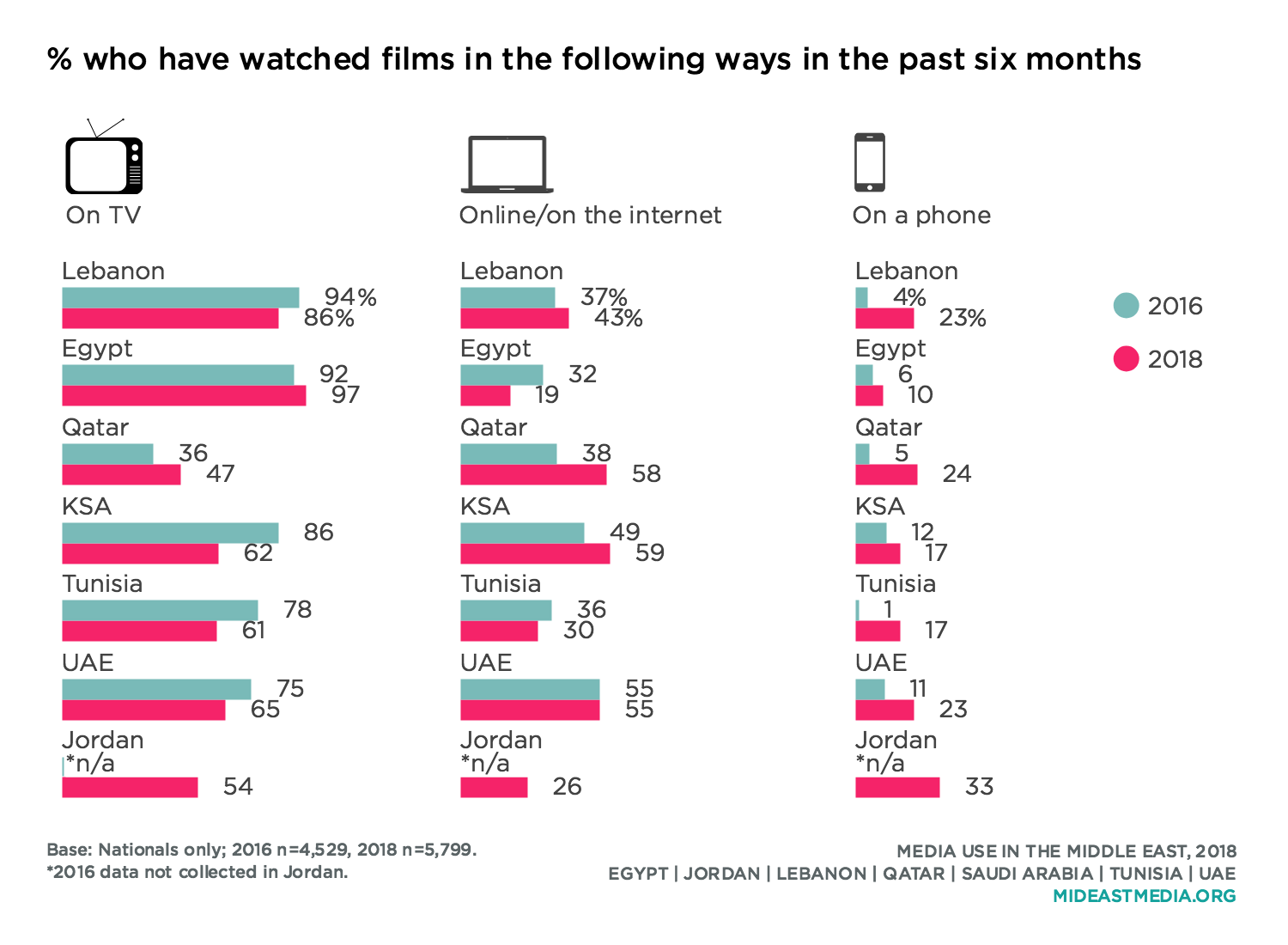

The platforms used watch films have changed since 2016. In most countries, nationals were less likely in 2018 than 2016 to say they watched films on a TV in the past six months, and more likely to have watched on a phone. Television, though, is still the dominant medium for watching films in all countries except Qatar, where more Qataris watch films online than on TV. Only about one in five of Arab nationals watched films on their phones in the past six months, but this represents a double-digit increase from 2016.

While nationals of all ages watched films on a TV set in the past six months, younger nationals are three times as likely as those 45 and older to watch films online or on a phone (online: 52% 18-24 year-olds, 44% 25-34 year-olds, 31% 35-44 year-olds; 16% 45+ year-olds; phone: 31%, 23%, 17%, 10%).

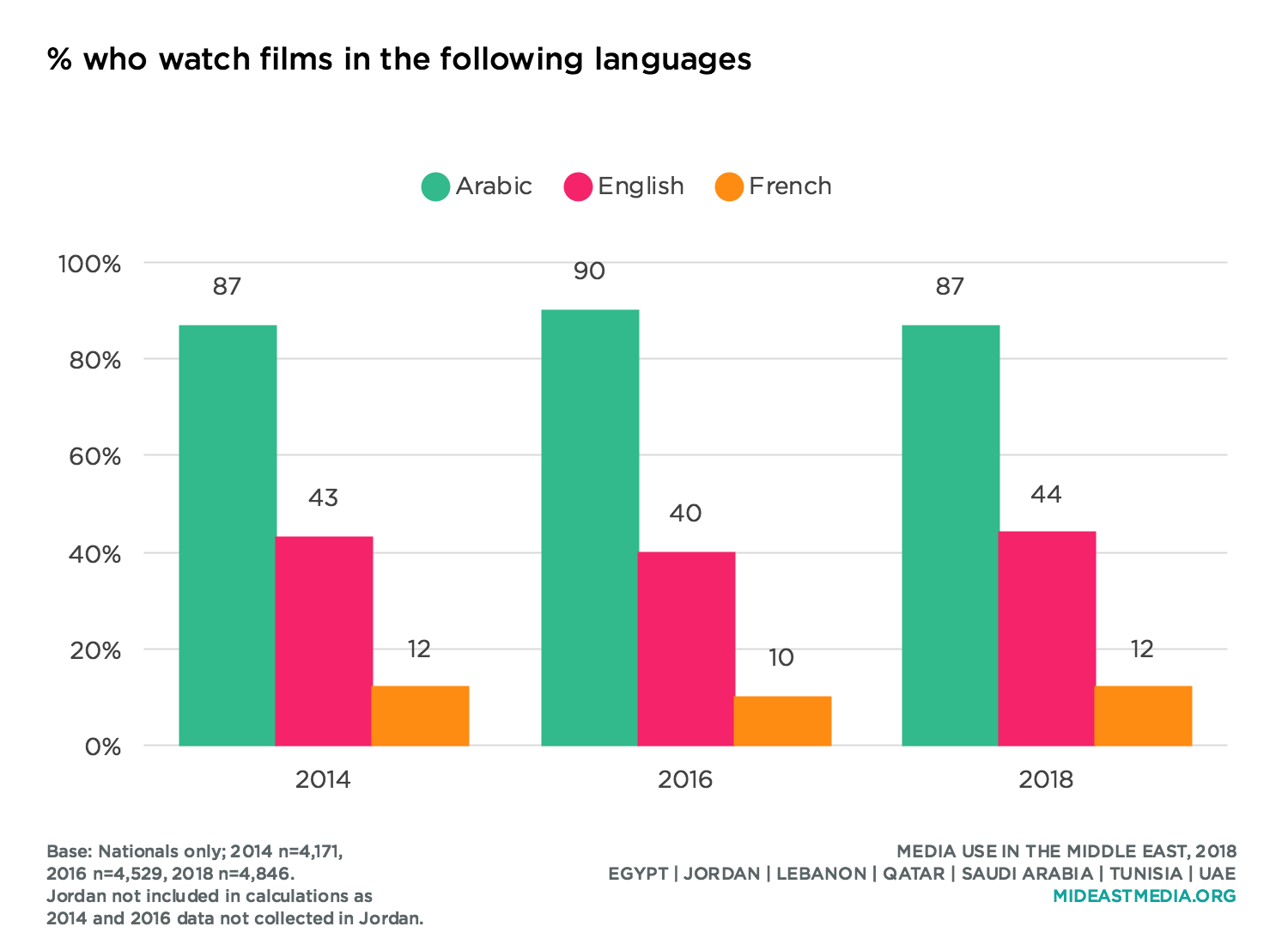

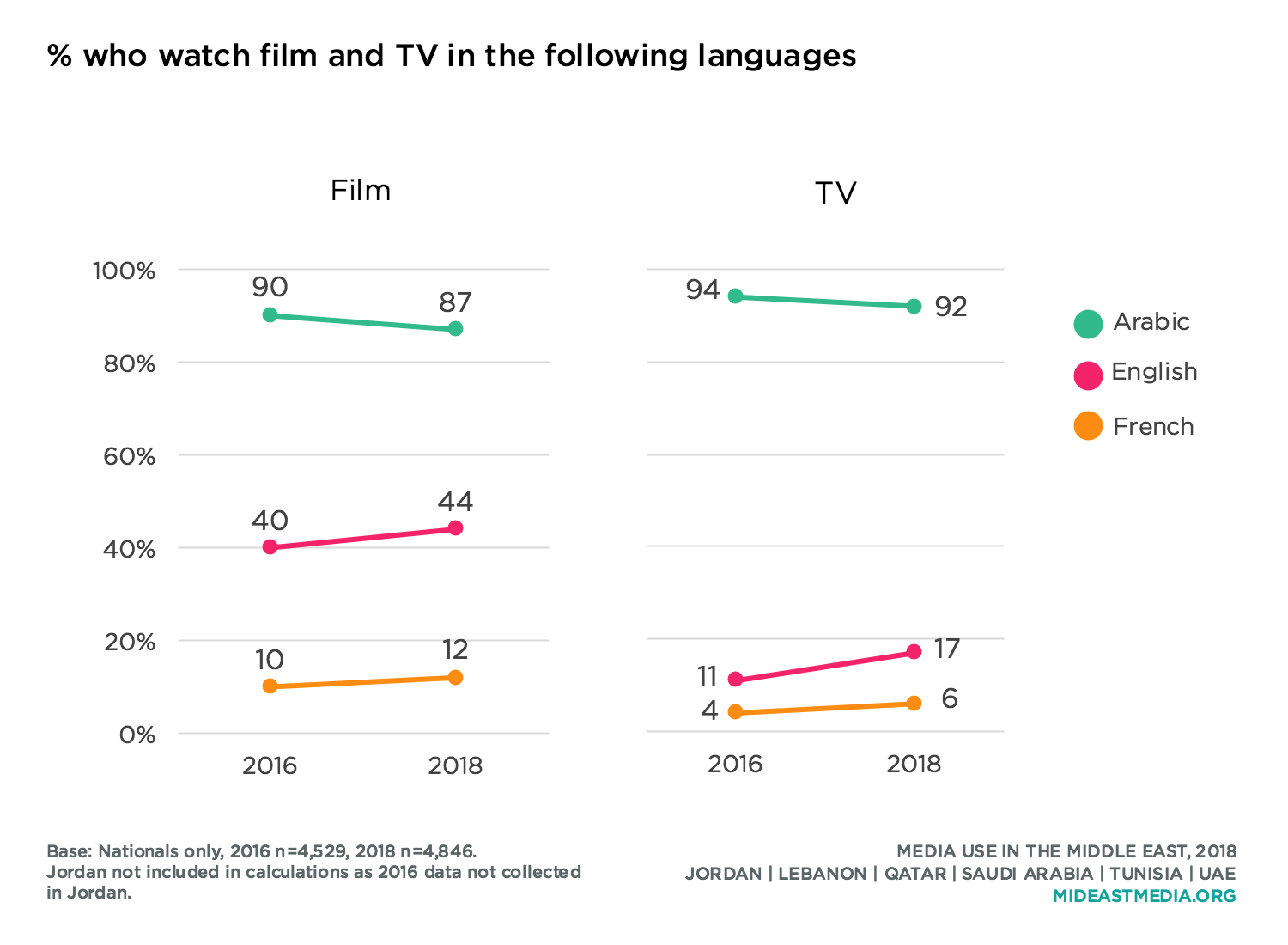

The languages in which Arab nationals watch films have changed little. Arabic remains the dominant language for films, with more than eight in 10 nationals watching films in that language. About four in 10 nationals also watch in English. Most nationals in Lebanon, UAE, and Qatar watch films in English (67%, 67% and 57%, respectively), while about one-third of Saudis, Jordanians, Egyptians, and Tunisians do so (39%, 33%, 32% and 29%, respectively).

Nearly all nationals watch both films and TV in Arabic, but they are twice as likely to watch films in English as TV in English.In fact, nationals are far more likely to watch films in English than to watch TV, listen to music or podcasts, or use the internet in English.

Interest in English-language films varies by key demographics. Men are much more likely than women to watch films in English (48% vs. 36%). The youngest age cohort is more than twice as likely to watch films in English as the oldest cohort (58% 18-24 year-olds, 47% 25-34 year-olds, 39% 35-44 year-olds, 23% 45+ years old). And the most educated nationals are more than nine times as likely as the least educated to watch in English (58% university or higher, 46% secondary, 27% intermediate, 6% primary or less).

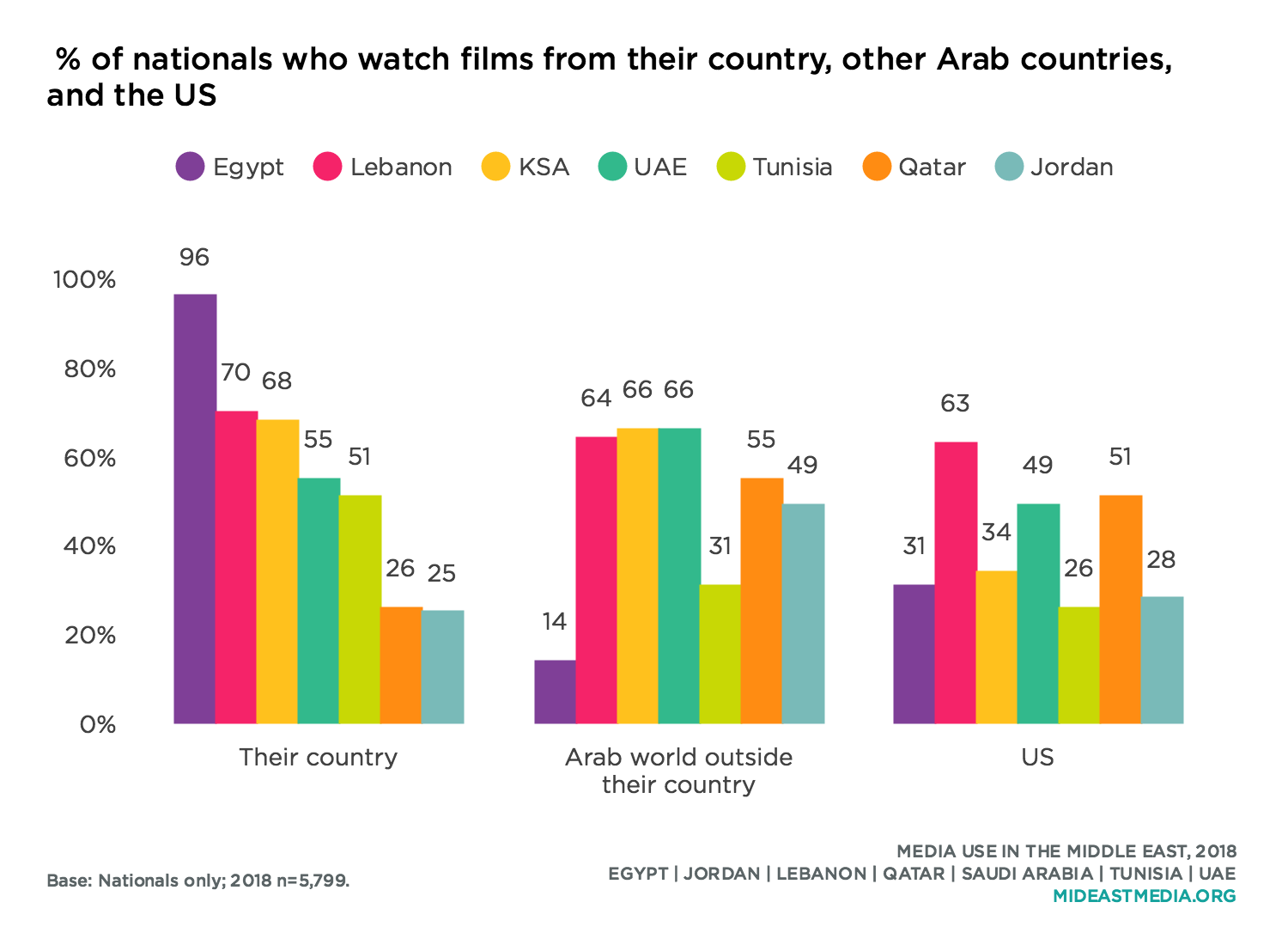

Most nationals in Lebanon, Saudi Arabia, Tunisia, and the UAE watch films produced in their own country, but only a quarter of Jordanians and Qataris watch films from their country. In fact, Jordanians and Qataris are twice as likely to watch films from other Arab countries than from their own country.

Interest in films from the U.S. varies widely across countries. Most nationals in Lebanon, Qatar, and UAE watch films from the U.S., while fewer in other countries do so. Lebanese nationals stand out for being equivalently likely to watch films from their country, other Arab countries, and the U.S. Egyptians are far more likely to watch films from their country (nearly all do) than films from any other locale.

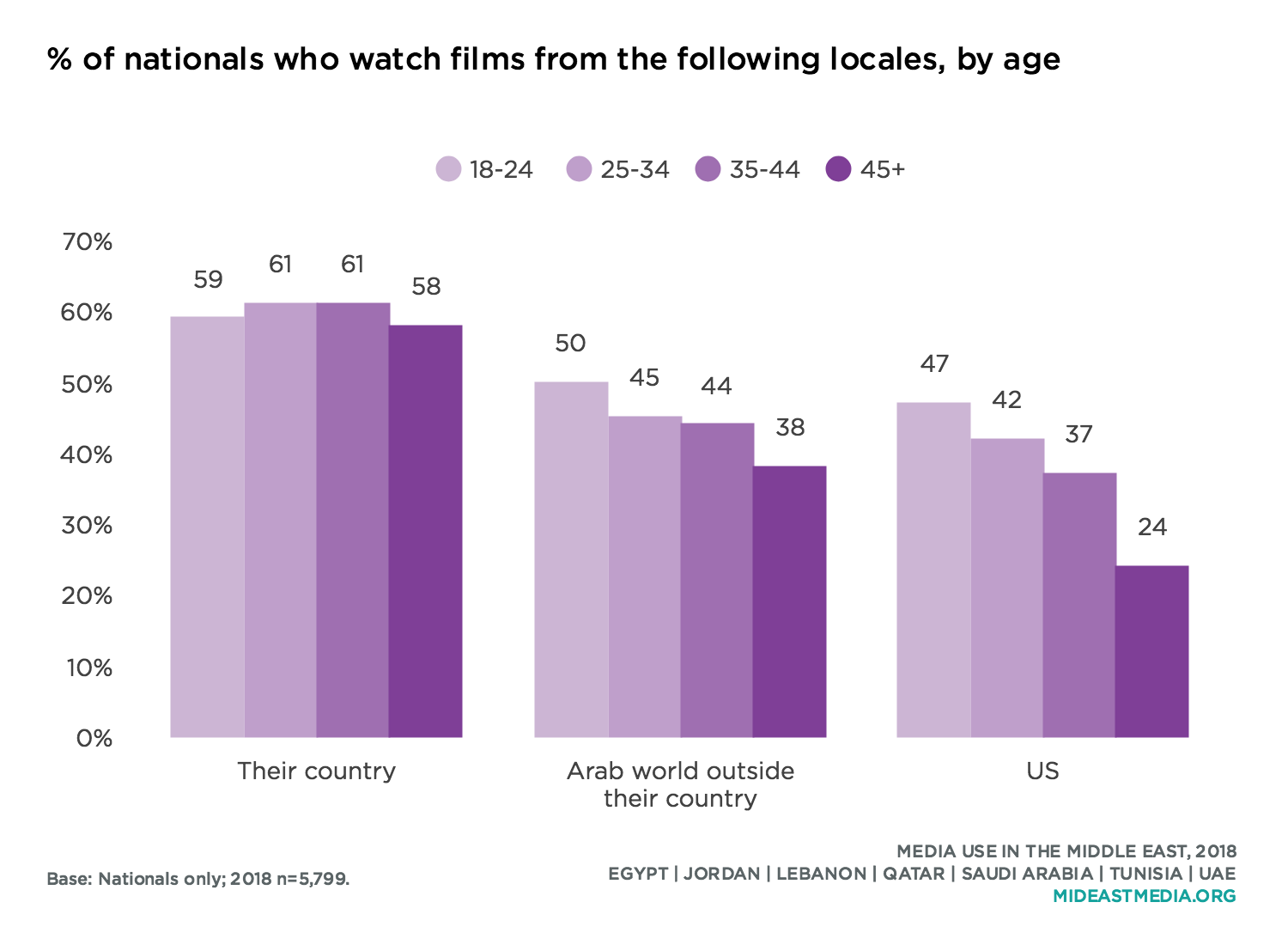

Films from the U.S. are more popular among younger nationals. Nationals 18 to 24 years old are twice as likely as those 45 and older to watch films from the U.S.

Nationals who identify as culturally progressive are more likely than their conservative counterparts to watch films from the U.S. and Europe.

Men are more likely than women to watch films from the U.S., while more women than men watch films from their own country (U.S.: 45% men vs. 30% women; their own country: 62% women vs. 58% men). University-educated nationals are five times as likely as those with a primary education or less to watch U.S. films (54% university or more, 40%, secondary, 24% intermediate, 8% primary or less).

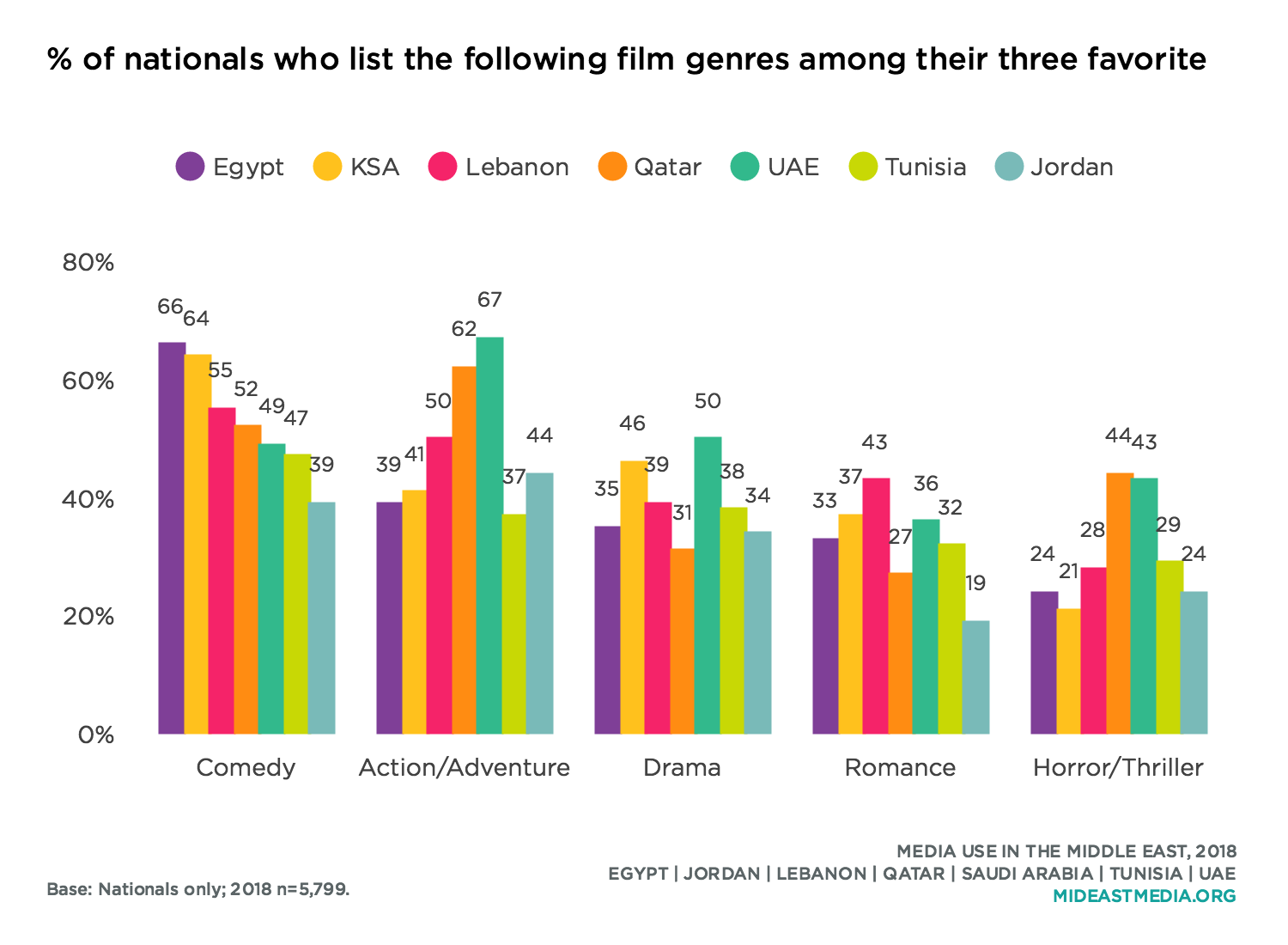

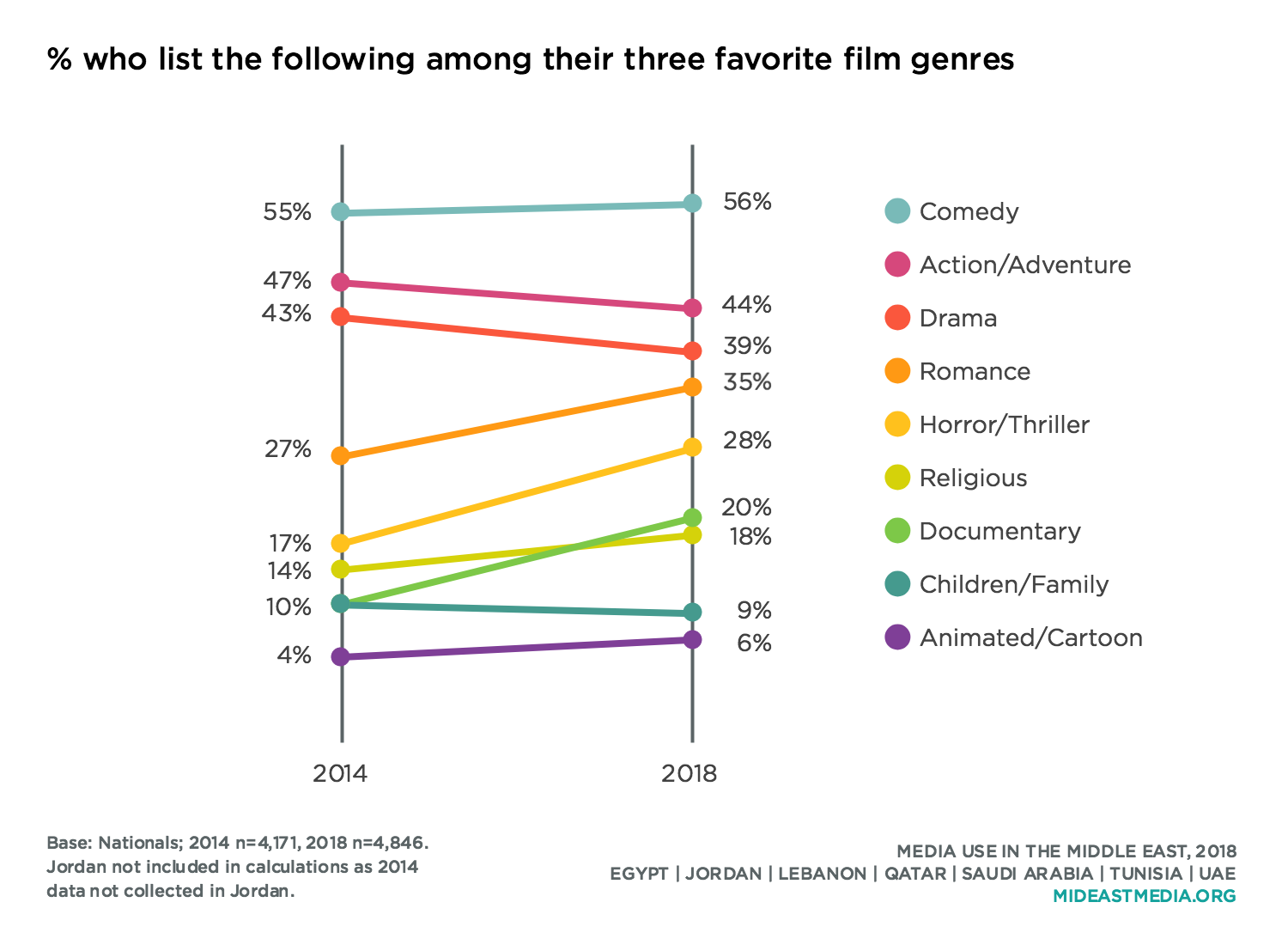

Comedy, action/adventure, and drama have been genres most-cited by Arab nationals as among their favorites in each of the entertainment-observant iterations of this study (2014, 2016, 2018), with little variation over time (cite the following as among their three favorite genres—comedy: 55% in 2014, 58% in 2016, 56% in 2018; action/adventure: 47%, 48%, 44%; drama: 43%, 45%, 39%). But there has been increased interest in other film genres as of 2018, including romance, horror/thriller, documentaries, and religious genres (romance: 27% in 2014 vs. 35% in 2018; horror/thriller: 17% vs. 28%; documentary: 10% vs. 20%; religious: 14% vs. 18%).

While film genre preferences are generally similar across countries, there are some notable variations. More Saudis than other nationals list comedy as among their three favorite genres, and majorities of Qataris and Emiratis list action/adventure and horror/thriller as favorite genres. Lebanese nationals are the most likely to enjoy romance films, while Jordanians are the least likely to cite the romance genre as a favorite. Egyptians stand out as being twice as likely as nationals from other countries to name Arab classic as a favorite film genre, and the percentage increased significantly from 2016 to 2018.

Both genders frequently cite comedy among their preferred genres, though men are more likely than women to say action/adventure and horror/thriller are among favorites, while women are more partial than men to drama and romance films (action/adventure: 62% men vs. 27% women; horror/thriller: 38% men vs. 17% women; drama: 46% women vs. 31% men; romance: 44% women vs. 21% men).

Age also plays a role in some film preferences. The youngest nationals are more likely than those in older cohorts to name action/adventure, romance, and horror/thriller among their favorite film genres, while older nationals are more likely to prefer documentary, religious, and Arab classic films (action/adventure: 57% 18-34 vs. 27% 45+; romance: 40% 18-24 vs. 20% 45+; horror/thriller: 39% 18-24 vs. 13% 45+; documentary: 25% 45+ vs. 16% 18-24; religious: 31% 45+ vs. 10% 18-24; Arab classic: 33% 45+ vs. 14% 18-24).

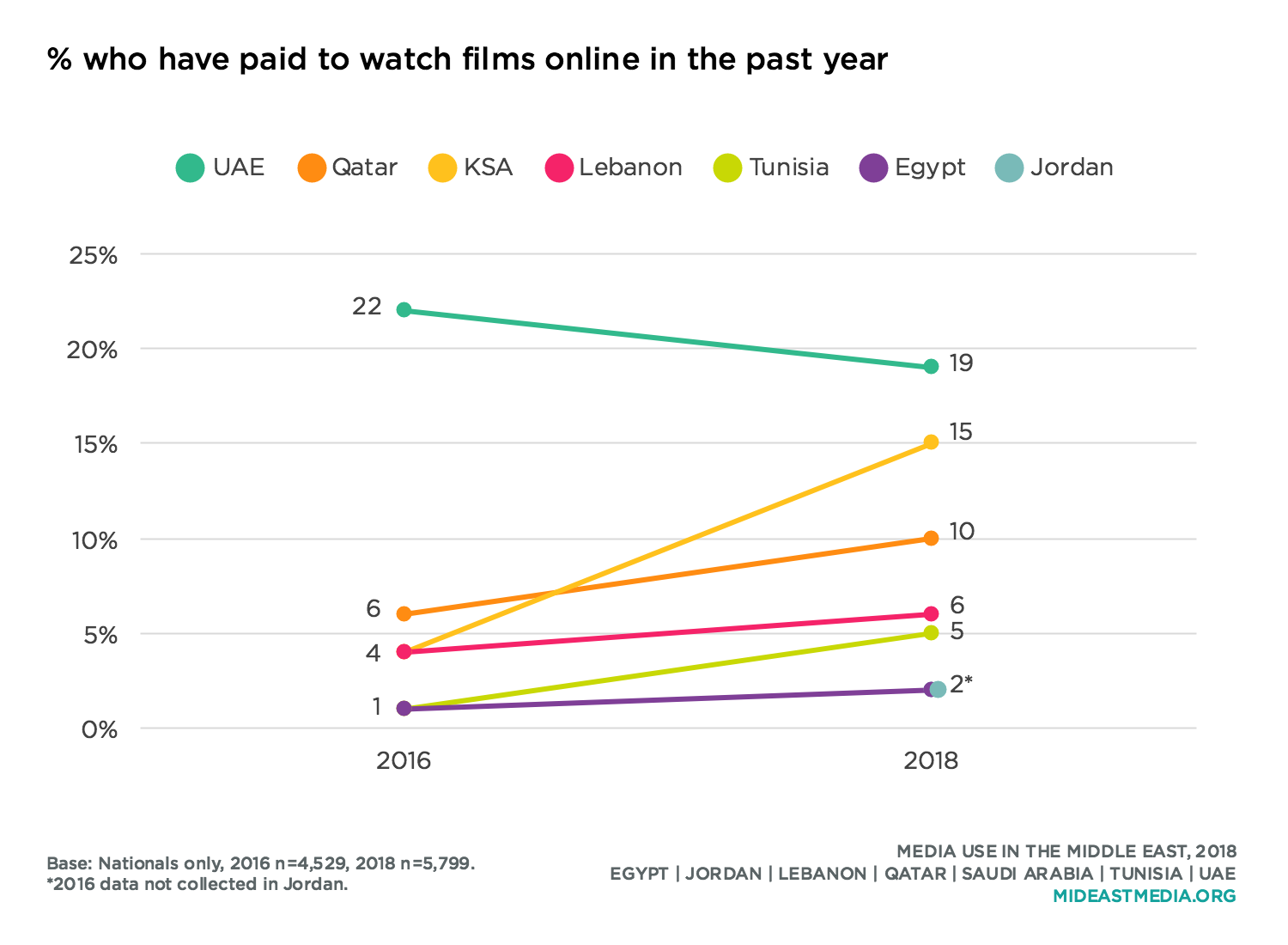

While many nationals watch films online, there was only a moderate increase between 2016 and 2018 in the proportion who have paid money to do so. The largest increase was in Saudi Arabia, where the number who have paid to access films online rose from 4% in 2016 to 15% in 2018. There were also moderate increases in Qatar and Tunisia (Qatar: 6% in 2016 vs. 10% in 2016; Tunisia: 1% vs. 5%).

While Arab nationals are generally not willing to pay for much online content, they are more likely to express willingness to pay for access to films and sports online than other content (9% sports, 8% film, 6% music, 4% video games, 3% TV shows, 3% news).

The youngest age group—18-24 year-olds—is nearly four times as likely to have paid to access films online in the previous year, compared to those 45 and older, but still only a small proportion of this group paid (11% 18-24 year-olds, 7% 24-35 year-olds, 6% 35-44 year-olds 3% 45+year-olds).

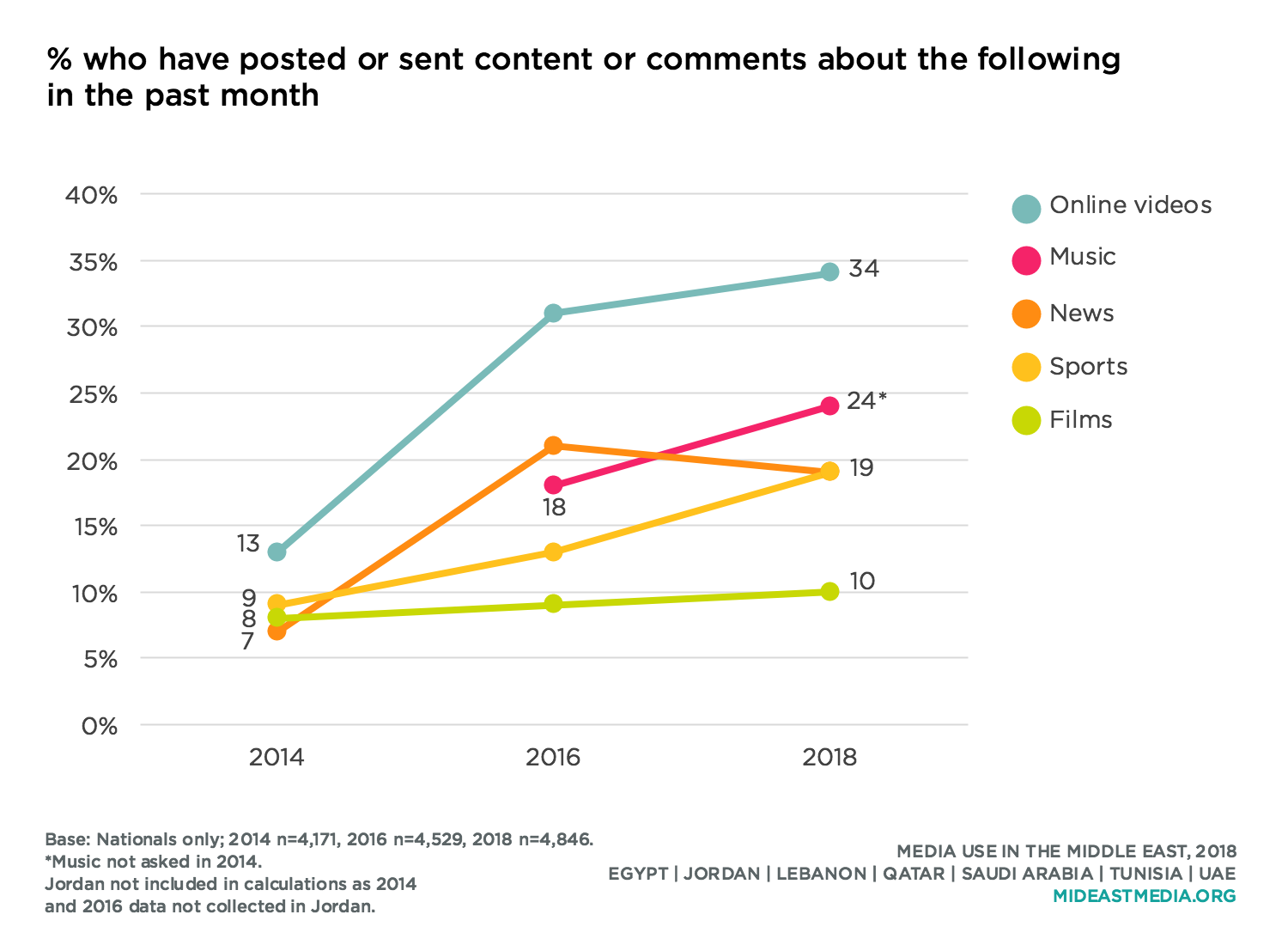

There has been an increase over time in the number of nationals who have sent, shared, or posted content or comments online on various topics. But of those topics, films are among the least likely to be the subjects of online posts. Nationals are much more likely to share about online videos generally, and also about music, news, and sports.

Fostering the new golden age of Arab cinema

Fatma Hassan Alremaihi, Doha Film Institute

Film is a mirror in which we see ourselves, and one that can change the world. The ability of film to provoke, influence, engage – and inevitably, change – perception makes it a powerful and influential medium. This insightful study by Northwestern University in Qatar on the region’s media landscape accurately presents from a unique perspective the relevance of film in the context of individual markets. The findings in this report reiterate the important ways that film is engaging our communities – and the potential for its growth in the region as an art form.

While across the board there is strong interest in watching Arabic films, almost no viewers in the region watch locally or regionally produced films. This reaffirms the need to prioritize investment in the development of our film industry in order to increase the quality and presence of Arabic cinema. We need to establish a vibrant sustainable ecosystem as well as a comprehensive resource hub that reflects our unique creativity and talent.

Since its inception, the Doha Film Institute has been committed to propelling Qatar’s film industry through training, production, and networking initatives focused on cinema appreciation, education. and development. The Institute’s efforts have seen significant successes, with a consistent output of regionally and internationally acclaimed award-winning films, but there is more to be done. We all must continue to invest in emerging talent and support artistic and technical development in a meaningful way.

Another notable highlight in the study is the increasing shift in the consumption of films from traditional to digital platforms. Although television remains a strong anchor, more and more people are watching content online and on smartphones – even if only a fraction of those who watch content on mobile devices pay for the service. This highlights new challenges ahead for filmmakers as traditional models of film financing continue to evolve, creating the need to reevaluate and identify alternate and creative forms of sustainable sources of revenue in today’s tech-driven era.

Online consumption of film has also democratized response to cinema – for better or for worse. In the age of citizen journalism, every Tweet, Facebook or Instagram post contributes to a massive social media voice where everyone is a critic, and films are rated, debated and commercial prospects predicted. This presents an opportunity to ensure fair representation of our narratives by promoting views and opinions from the Arab world in the online community. By fostering the sense of belonging and identification identity that comes from bolstering the visibility of original content from our own perspectives, we secure the growth of a relevant and current artistic community.

Taking a pragmatic view of the report, the findings predominantly point to a crucial need to align our local film industry to fill the wide gap in volume and overall quality, and great potential to fulfill a desire for Arabic content that is both meaningful and entertaining. Accurate representations of our people and the region are essential for bridging understanding and challenging stereotypes and misconceptions about Arabic culture that permeate popular art and media.

Film is a universal media that transcends typical limitations of other mass communication, bringing together people from discrete communities and disparate geographies into a common space of visual storytelling. As much as it highlights individual traits and challenges, on a fundamental level, it unites us all through common hopes, dreams and core values. Using this unity to work towards positive change by acknowledging and respecting cultural differences and countering destabilizing prejudices, we will better address the societal ills that are pervasive in all of today’s communities – regardless of geography.

Significant expansion in the local, regional and global reach of cinema can be credited to the continued shift of media use platforms from the big screen all the way to smart screens. With this comes the requirement for more powerfully engaging content to retain audience interest – and an opportunity to put our best foot forward in showcasing our culture and creativity in an authentic way.

The Doha Film Institute focuses its year-round calendar of activities towards the vision of empowering the current generation of visual storytellers to have confidence in their voices and providing a solid foundation for the leaders of the next golden age of Arab cinema. The findings of this report illustrate the opportunity and necessity for a commitment to prioritize contribution to our film and creative communities. I encourage all of you who are inspired by this report to embark on your own journeys to step out, dare to dream, and make your dreams reality on the screen.