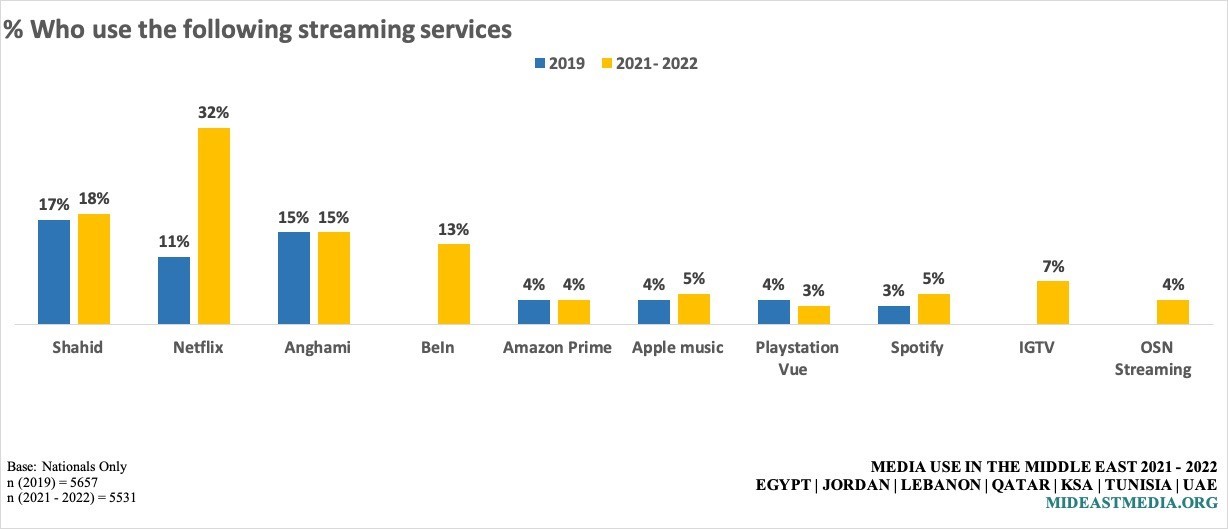

Streaming services remain the preferred option for the consumption of entertainment content. Netflix experienced a disproportionate increase in adoption in comparison to last year, and this could be due to prolonged period of lockdown that saw many users in the region binge watching content on the platform. Local platforms Shahid and Anghami, remain popular and experienced little to no change over the 2019-2021/22 period. However, Bein marks a relatively similar rate to local platforms, perhaps due to their sports offering and the imminent arrival of the World cup to the region.

Figure 12: Access to different online streaming services

In this sense, looking at the numbers over half of nationals are using streaming services (52%), with Netflix (32%) leading streaming services in the region followed by Anghami (15%), Shahid (18%), and Bein (13%). Platforms that have enjoyed a degree of popularity in the American and Western European market, like Amazon Prime, Apple Music, and Play Station Vue, have shown little change, with only Spotify, showing a meagre 2% increase. Another local platform, OSN has shown a timid adoption rate of 4%, which seems significant given the fact that it was not mentioned during the 2019 survey as a significant actor in the Arab market. IGTV, is perhaps another interesting outlier, considering Instagram is only a social media platform.

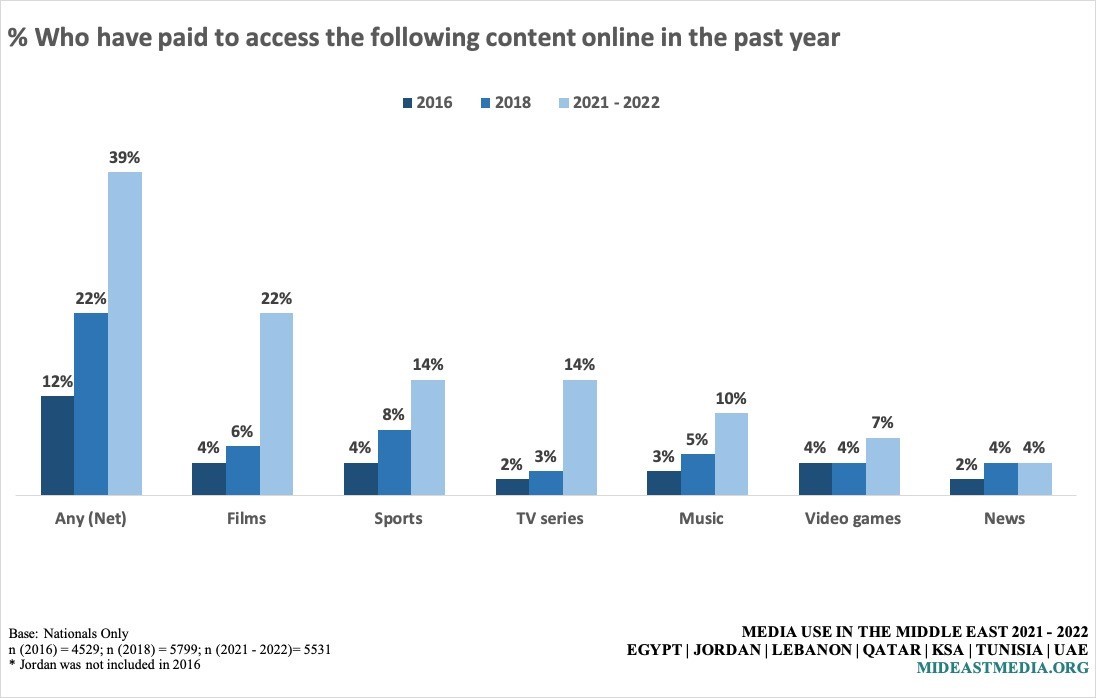

Figure 13: Paying for online entertainment content

Given the popularity of streaming platforms as means for accessing entertainment content, it is not surprising that paying for online content significantly increased since 2018 with more nationals who have paid for any content online than in 2018 (22% in 2018 vs. 39% in 2021-2022). Films are the most-paid-for content in the region in the past year (22%), followed by sports (14%), and TV series (14%). The latter grew 11 percentage points.

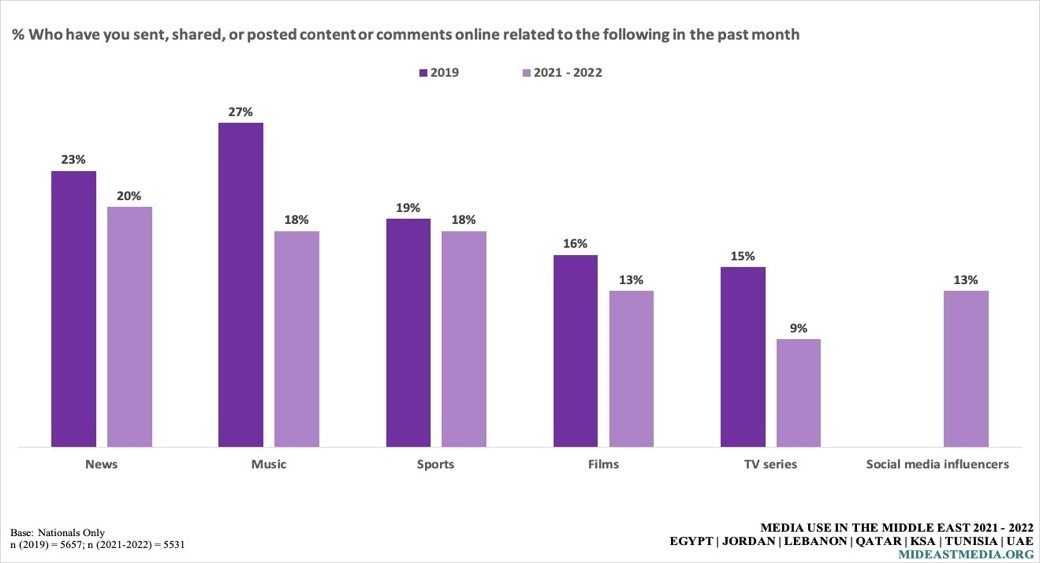

Figure 14: Posting comments, sharing, and sending online content

In terms of engagement, sending, sharing, and commenting on entertainment content persists at lower rates in the region. News (20%), music and sports (18% each) are the most-engaged-with content online, while TV series content online recorded the least engagement rates (9%). While it was not part of the question in previous years, content by media influencers marked 13% in the 2019-2021/22 period.

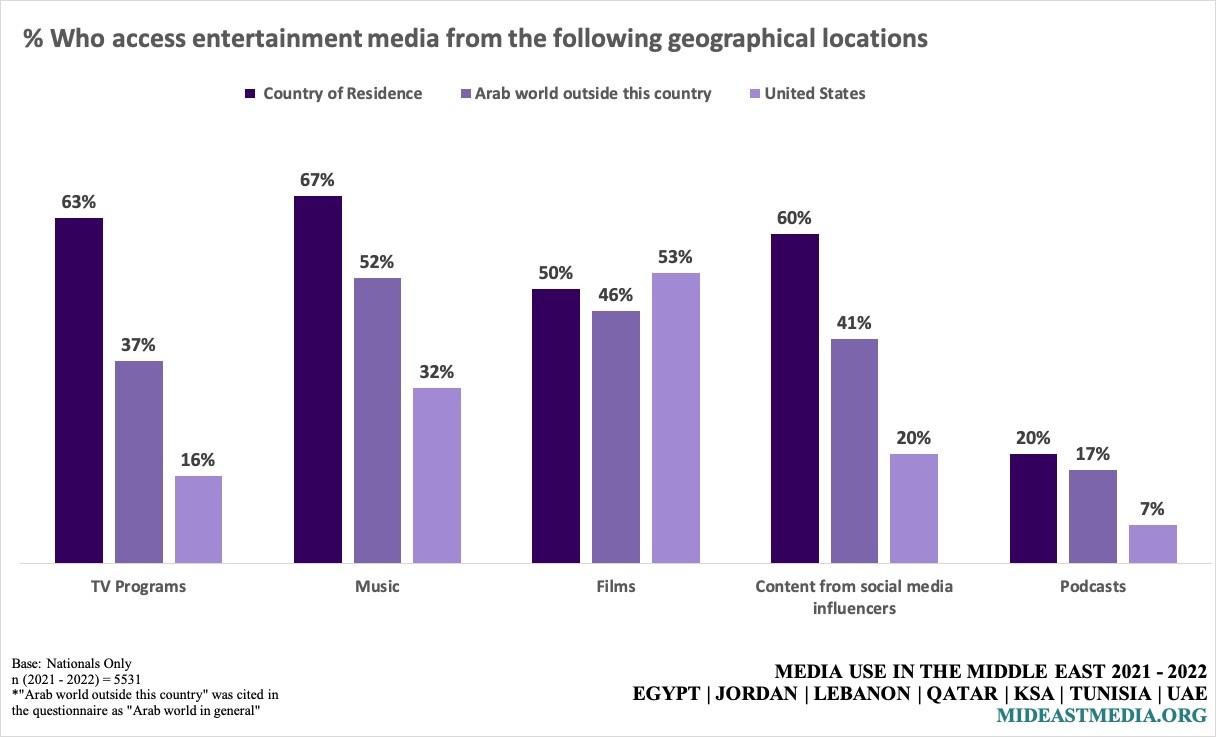

Figure 15: Access to entertainment media from different geographical locations

Consuming content from country of residence is dominant in Television programs, music, content from influencers and podcasts, followed by regional content. This can be explained by either the strong sentiment and preference for content based on the region’s history and culture as well as Arabic preference in all media forms. The only exception to the reign of local content are films, with over half nationals (53%) watching films primarily from the United States of America

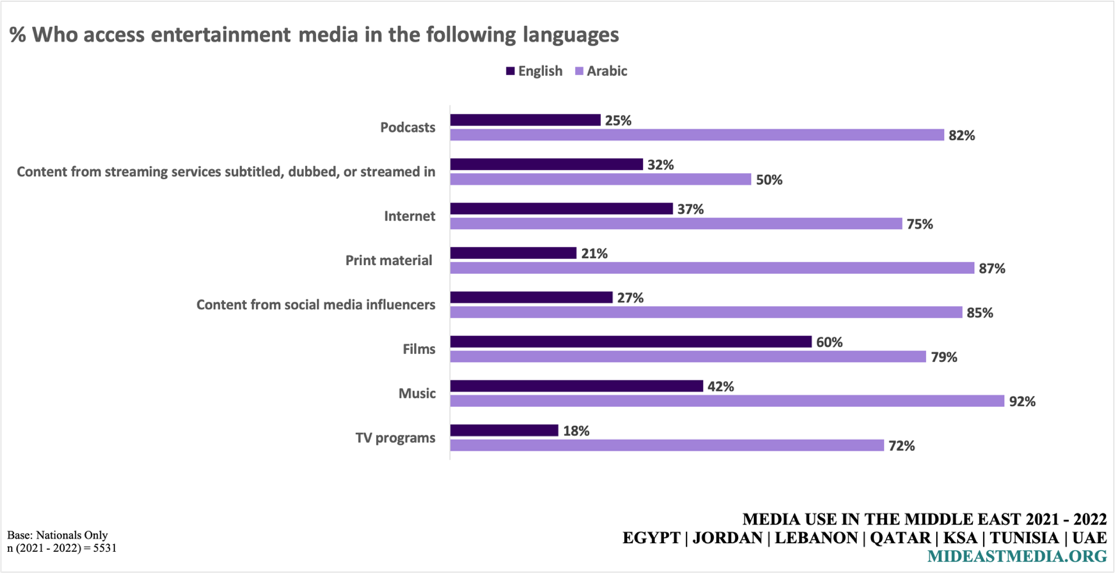

Figure 16: Accessing forms of entertainment media in different languages

Much like previous years, all media content is consumed primarily by a strong majority of nationals in Arabic. Consumption of entertainment media in English ranges between 18% for television programs and 60% for films.

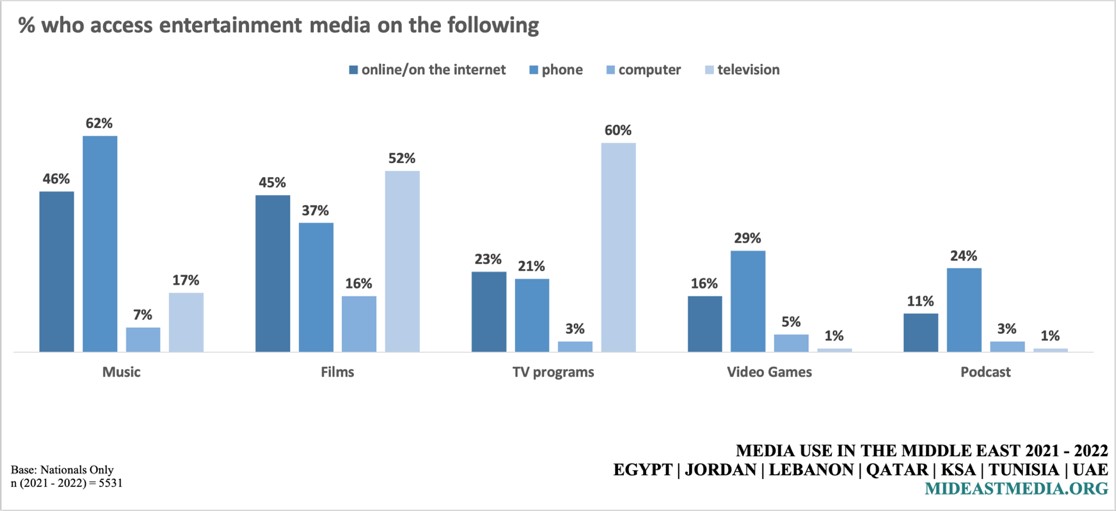

Figure 17: Media used to access different forms of entertainment content

Media access has witnessed a clear shift, with growing need for entertainment content, rising rates of internet penetration, and smartphone ownership. Although online film watching significantly increased during the global pandemic (42% in 2014 vs. 74% in 2021-2022), television reigns as the main medium used to watch films (52%) and television programs (60%) in the region.

Logically, given the portable nature of this kind of content, phones are the most used media to listen to podcast (24%) and music (62%). Notably, the surveyed participants prefer to play games on their phone (29%) rather than on their TV sets at home (1%), which highlights a shift towards more portable games to kill time.

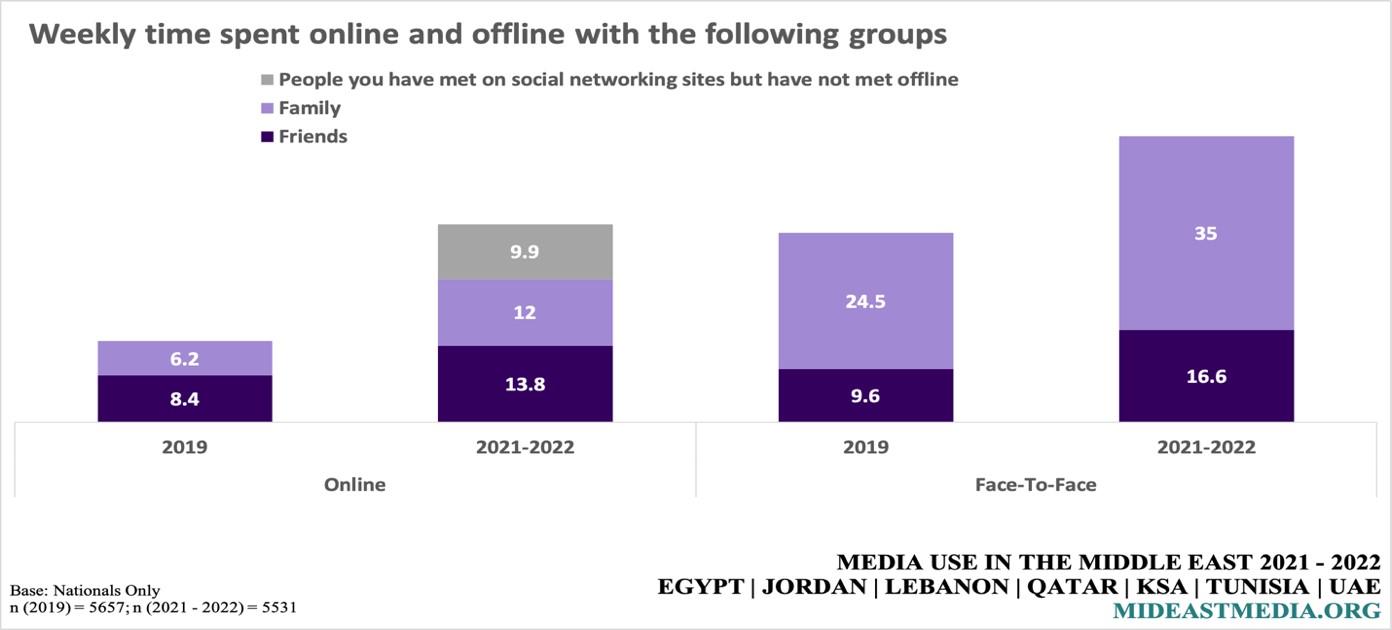

Figure 18: Time spent with different groups online and offline

Given the significant shift in the time spent on and offline with different groups, the results of figure 18 need to be analyzed in the context of the world pandemic. Understandably, and thanks to the prolonged period of lockdown, time spent weekly with family and friends has both increased online and offline since 2019. The increase online could be attributed to the use of videoconferencing and social media as primary means to connect and interact with family and friends remotely, whilst the marked increased in time spent offline could be due to the time people spent with family members (and to a minor extent with friends) leaving in lockdown. Nationals associate socialization face-to-face with family members, while they spent relatively equal time with family and friends online.