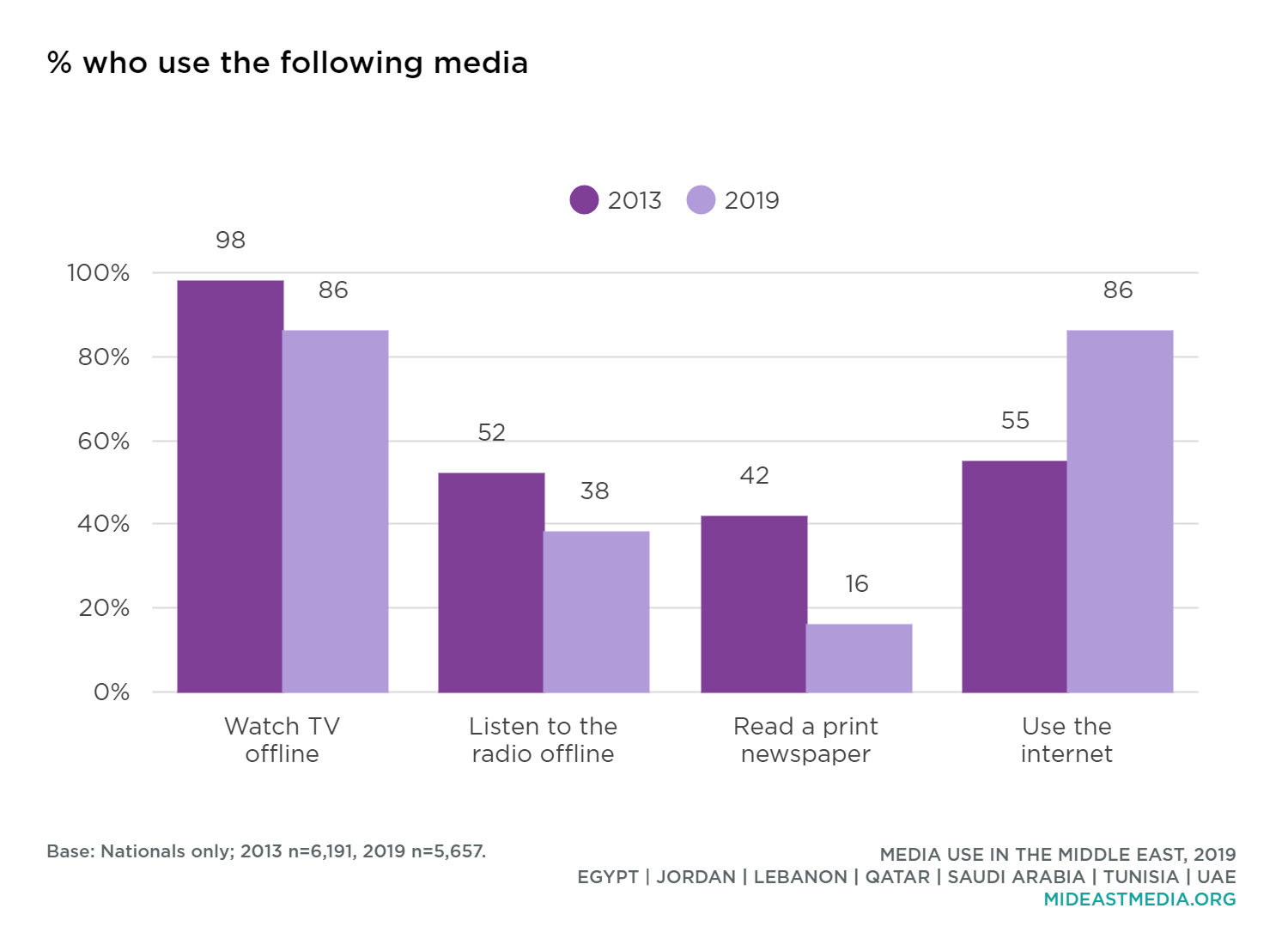

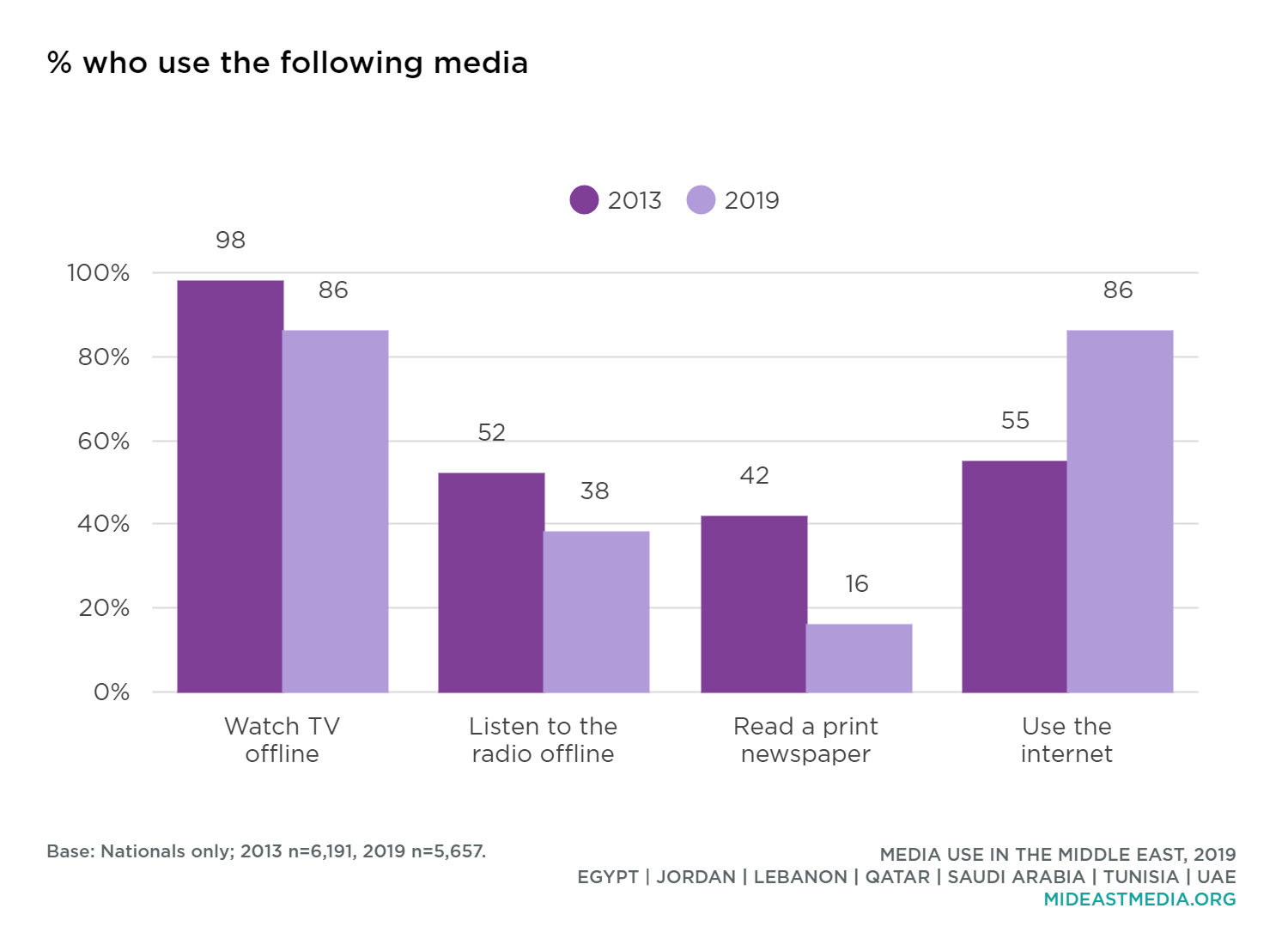

Compared to 2013, far more Arab nationals in 2019 use the internet, and nationals in some countries are spending more time online, possibly cutting into their use of offline media, including TV, radio, and print newspapers. Use of traditional media has declined in all surveyed countries. The percentage of nationals who watch TV fell most sharply in Qatar and Jordan from 2013 to 2019 (down 26 and 22 percentage points, respectively).

Since 2013, print newspaper readership declined by more than 50 percentage points in Qatar and the UAE and by more than 30 points in Tunisia and Jordan (55 points in Qatar, 53 points in UAE, 34 points in Tunisia, 33 points in Jordan). Although newspaper readership declined by 15 points in Saudi Arabia, 44% of Saudis still read a print newspaper. Radio use increased by 10 percentage points in Egypt from 2013 to 2019.

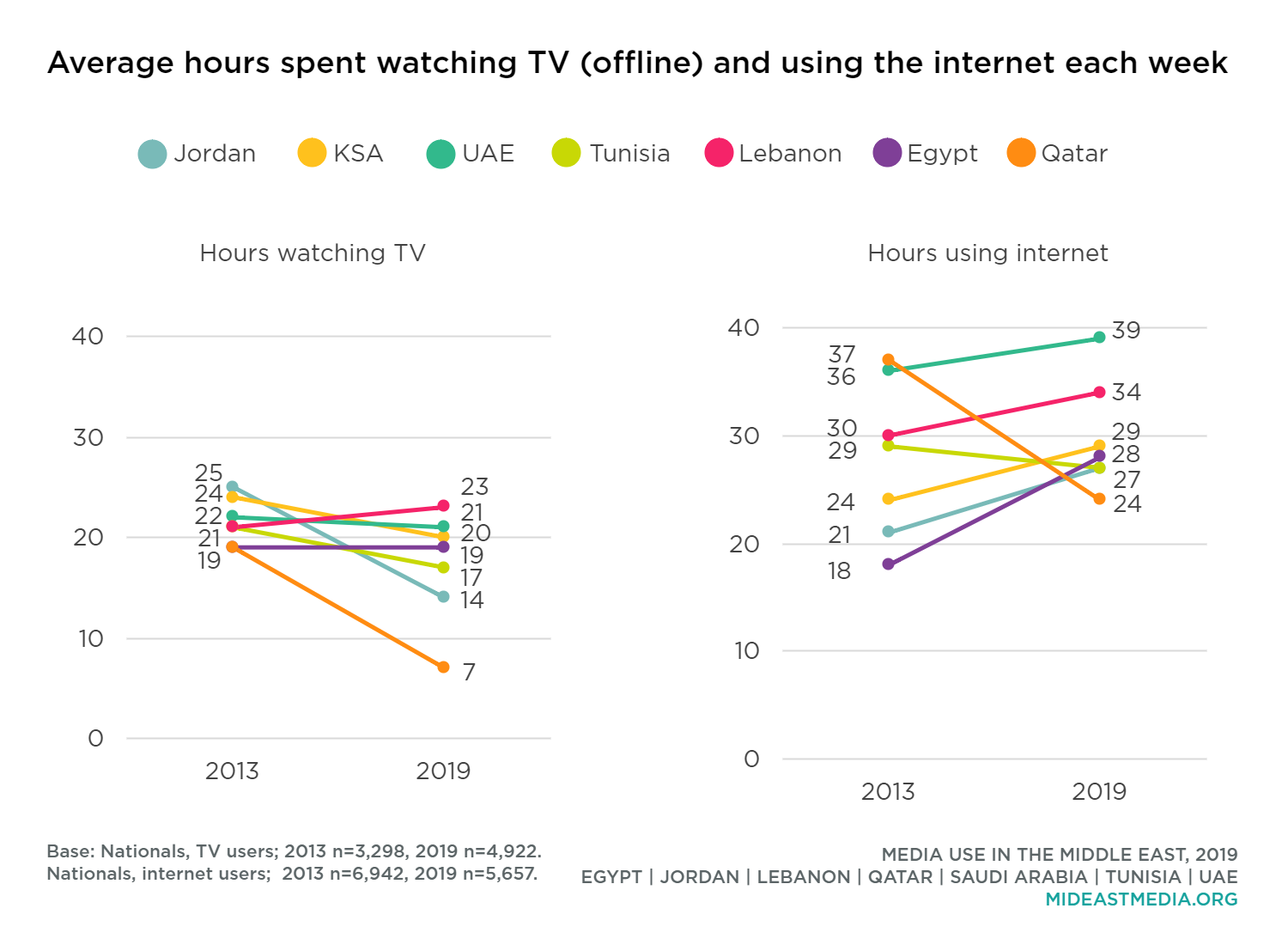

Overall, nationals in the region spend more time each week online than watching TV (30 hours vs. 19 hours, on average, among users of each medium). This disparity is seen in all countries surveyed. Moreover, time spent watching TV has declined since 2013 in most countries, while the time spent online has increased in all countries except Qatar.

Women are more likely than men to watch TV and spend more time doing so on average (watch TV offline: 90% women vs. 83% men; hours watching TV offline each week: 20 hours women vs. 17 hours men). The oldest nationals (45+) are more likely to watch TV than the youngest group (18-24) and report spending more time doing so (watch TV offline: 90% 45+ year-olds vs. 83% 18-24 year-olds; hours watching TV offline each week: 22 hours 45+ year-olds vs. 17 hours 18-24 year-olds). Comparatively, men and younger nationals spend more time online each week than their counterparts (gender: 31 hours men vs. 28 hours women; age: 36 hours 18-24 year-olds vs. 21 hours 45+ year-olds).

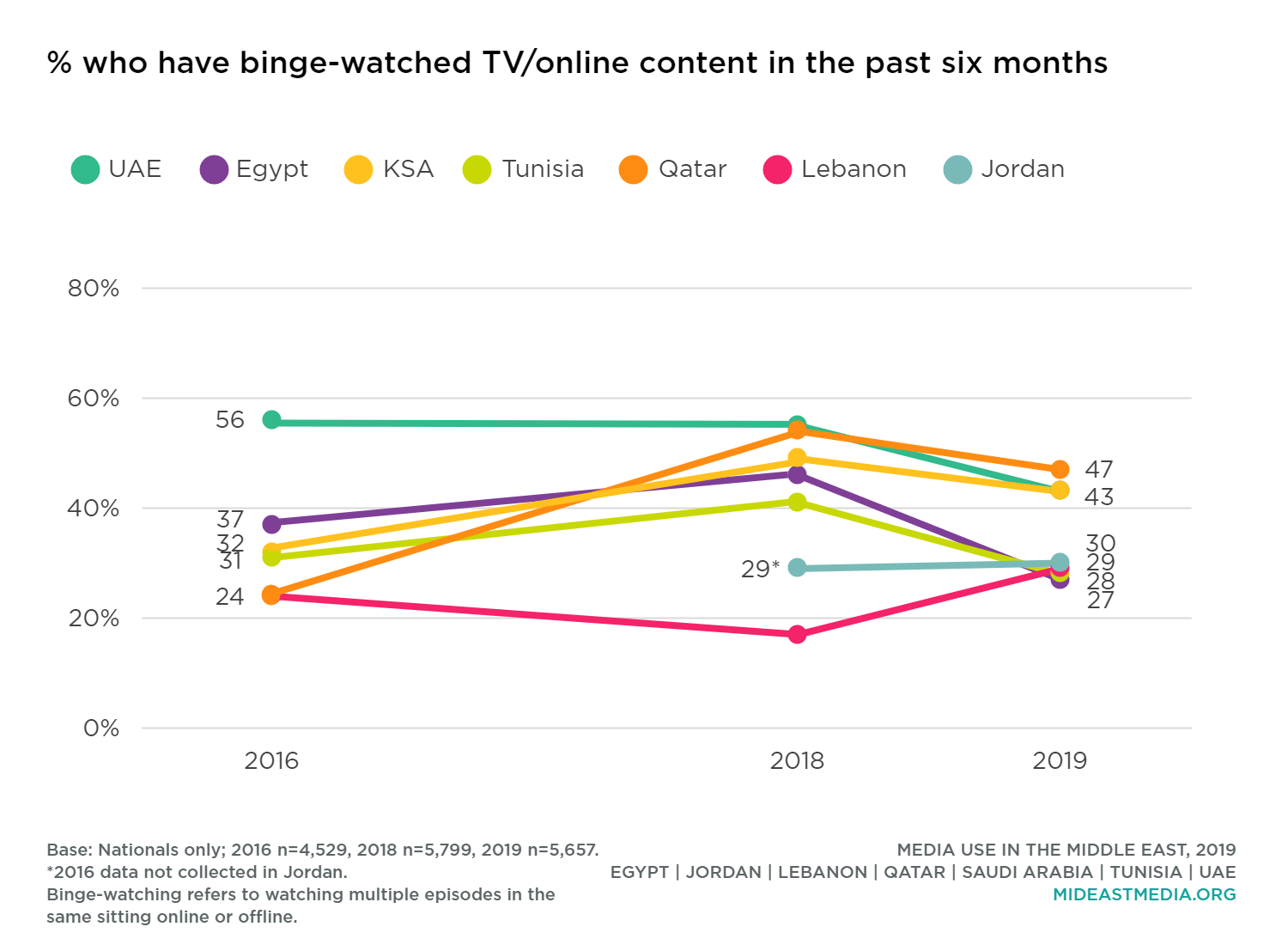

Binge-watching has not taken hold in Arab countries in this study, at least compared to binge-watching frequency reported in other parts of the world. Asked if they had watched two or more episodes of the same TV/online program in one sitting in the prior six months, about one-quarter to one-half of Arab nationals report binge-watching—ranging from 27% in Egypt to 47% in Qatar—figures largely unchanged from 2016. In comparison, Limelight Networks’ State of Online Video 2019 survey reported a binge-watching rate of 80% among Americans.

Women and younger nationals binge-watch at slightly higher rates than their male and older counterparts (gender: 39% women vs. 26% men; age: 39% 18-24 year-olds, 34% 25-34 year-olds, 28% 35-44 year-olds, 26% 45+ year-olds). Non-nationals—Western expats in particular—are far more likely than Arab nationals to binge-watch TV/online series, perhaps to watch content from their own countries (65% Western expats, 52% Asian expats vs. 36% Arab expats, 32% Nationals).

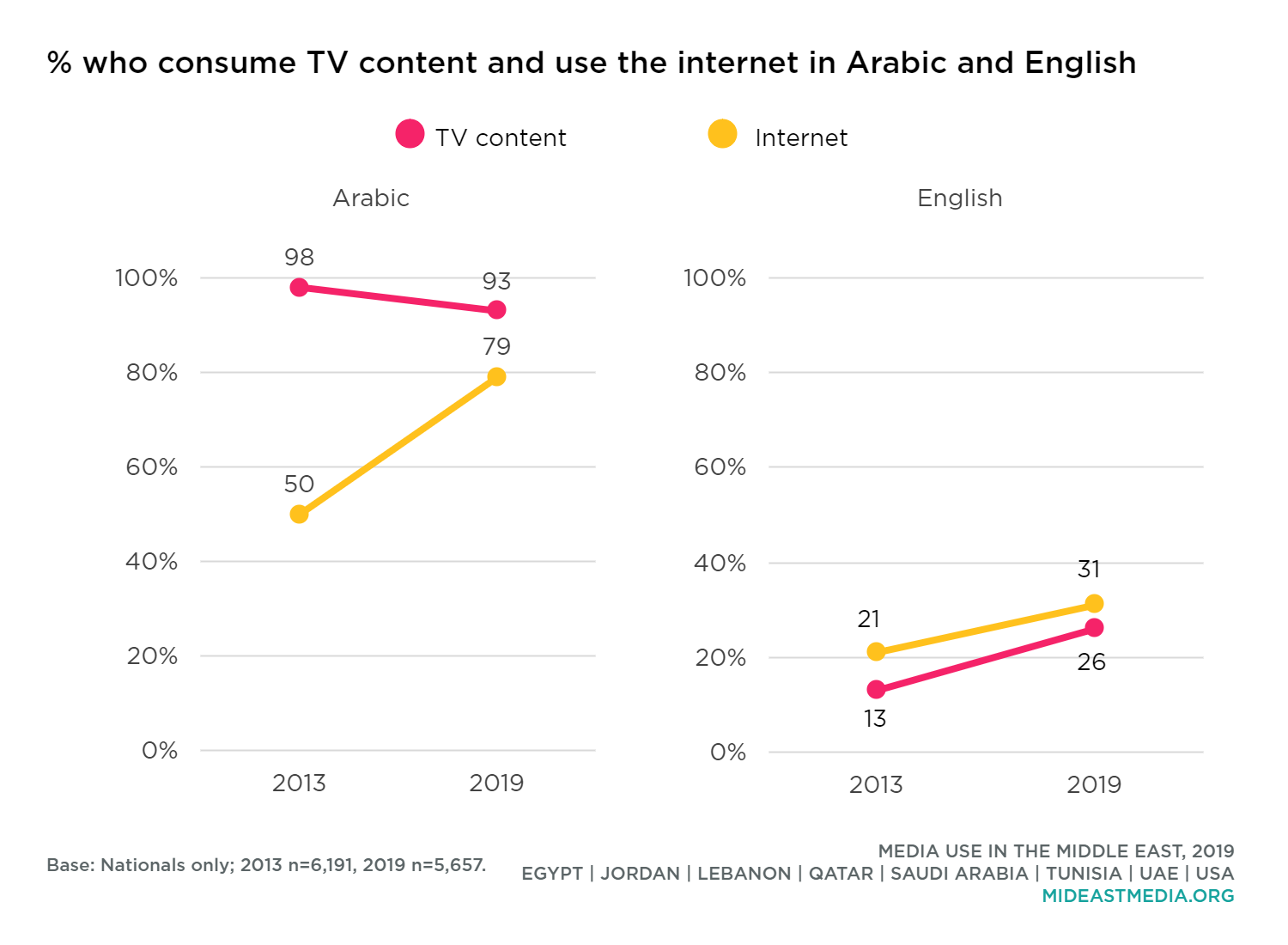

Arabic is by far the preferred language for TV and internet content, with at least eight in 10 nationals using Arabic for both. In comparison, just three in 10 use the internet and one-quarter watch TV content in English, although this represents an increase since 2013 of 10 and 13 percentage points, respectively.

Men are more likely than women to watch TV and use the internet in English (TV: 28% men vs. 24% women, internet: 33% men vs. 28% women). Consuming English content on TV and online are more common among younger respondents (TV: 34% 18-24 year-olds, 31% 25-34 year-olds, 25% 35-44 year-olds, 14% 45+ year-olds; internet: 43% 18-24 year-olds, 38% 25-34 year-olds, 27% 35-44 year-olds, 13% 45+ year-olds). Viewing in English also increases with education (TV: 1% primary education or less, 13% intermediate, 27% secondary, 37% university or higher; internet: 2% primary education or less, 12% intermediate, 31% secondary, 46% university or higher).

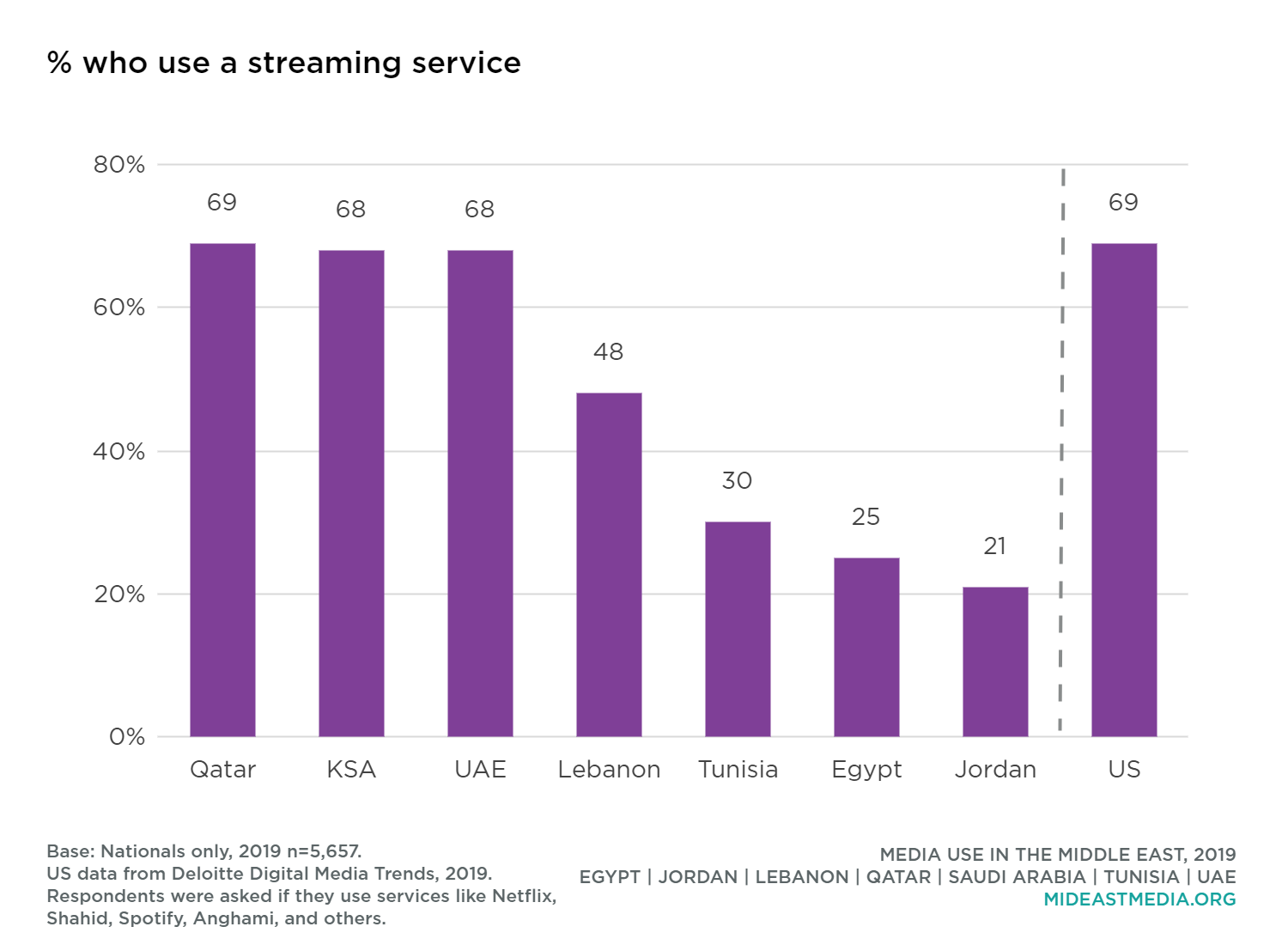

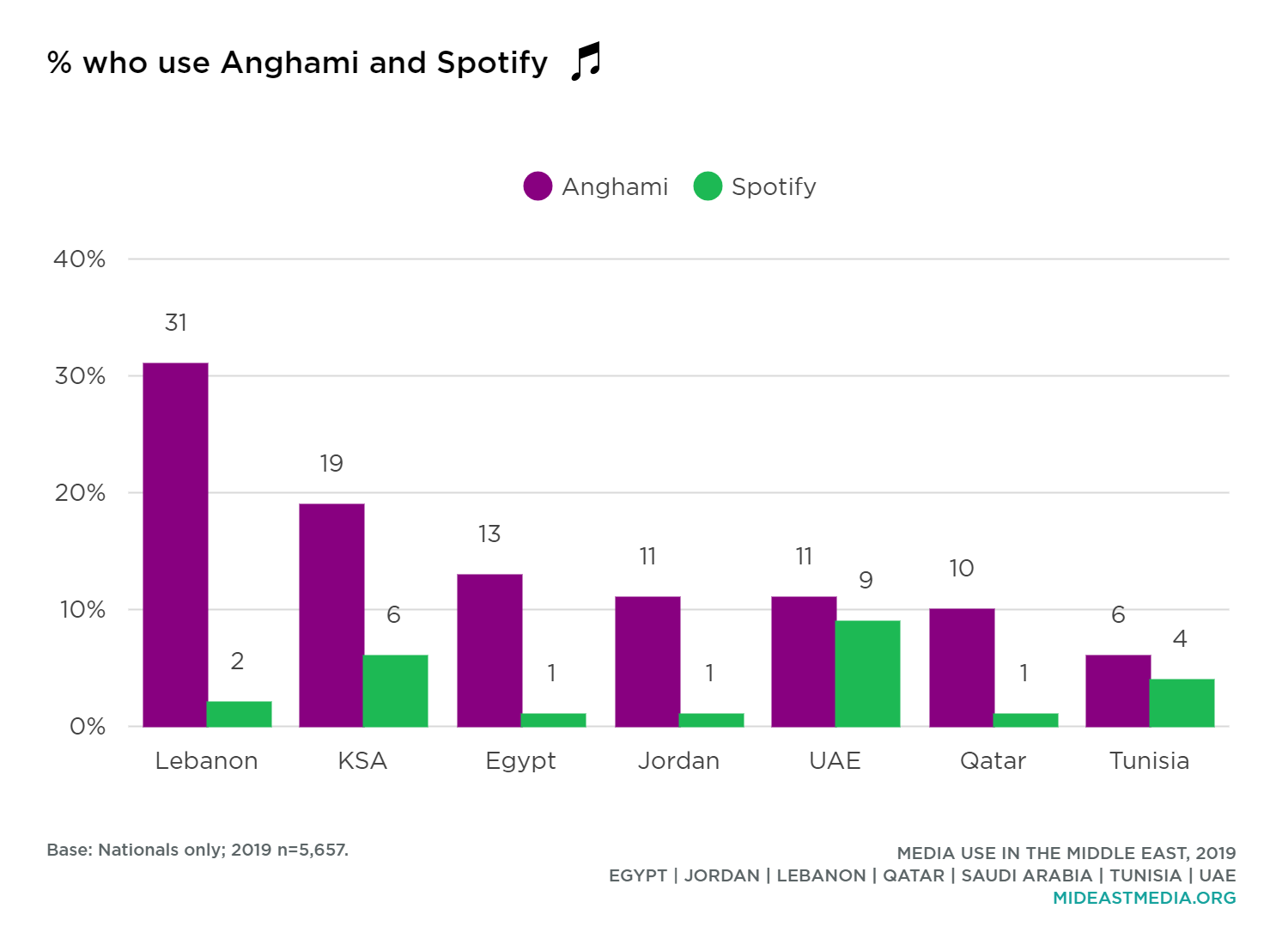

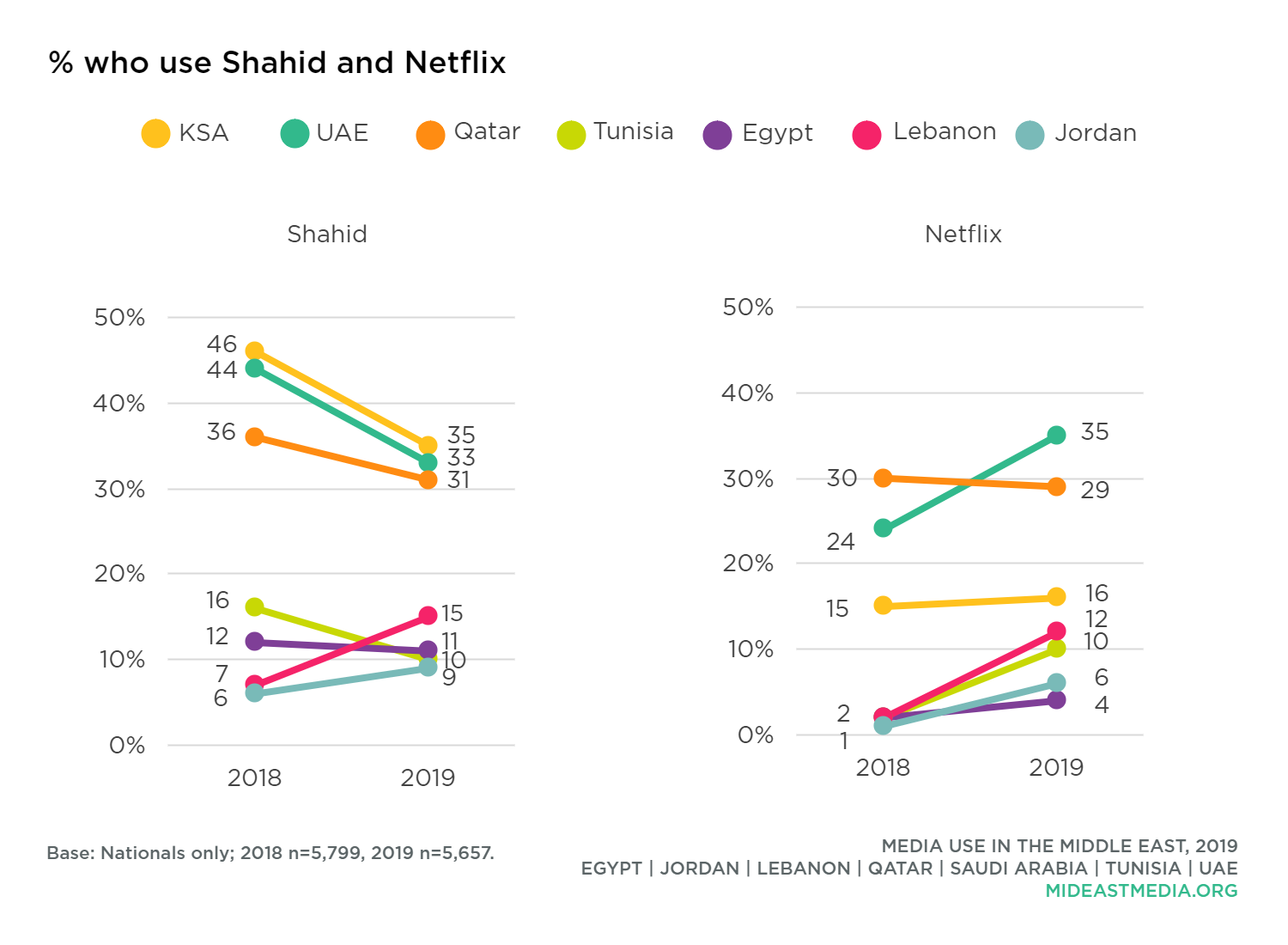

Streaming services are gaining popularity in the Arab countries in this study. Two-thirds of Qataris, Saudis, and Emiratis report using a streaming service (like Shahid, Anghami, and Netflix, or others), a figure similar to that in the U.S. (Deloitte, 2019). These services are less common, however, in other Arab countries. Shahid, Anghami, and Netflix are the most popular streaming services (Anghami offers music streaming; the other two are video entertainment portals). Shahid and Netflix are used by a greater proportion of nationals in the UAE and Qatar than in other countries. Shahid is most popular in Saudi Arabia, while Anghami is more common among nationals in Lebanon than elsewhere.

Compared to 2018, fewer nationals in the Arab Gulf countries use Shahid, while Netflix is more popular among Emiratis now than in 2018. Lebanese have increased their use of both of these streaming services.

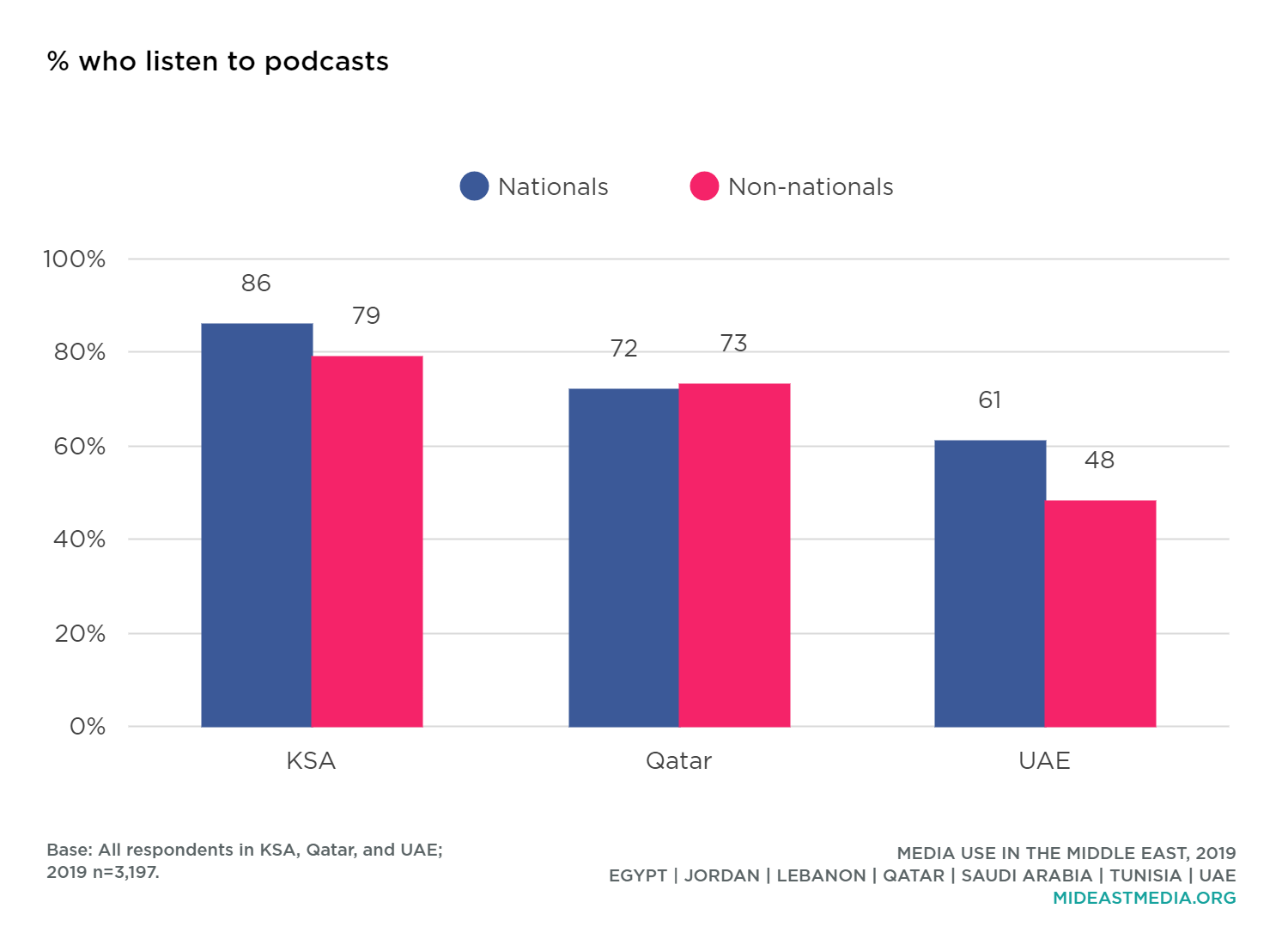

Podcast use varies widely by country. Two-thirds of Saudis listen to podcasts weekly, compared to less than two in 10 Egyptians and Jordanians. Podcasts are more popular in the Arab region than in the U.S. Weekly podcast listenership is higher in five of the Arab countries in this study than in the U.S. (U.S.: 22%, Pew Research Center, 2019).

More non-nationals than nationals listen to podcasts weekly, especially Western expats (60% Western expats vs. 38% Asian expats, 35% Arab expats, 30% Nationals).

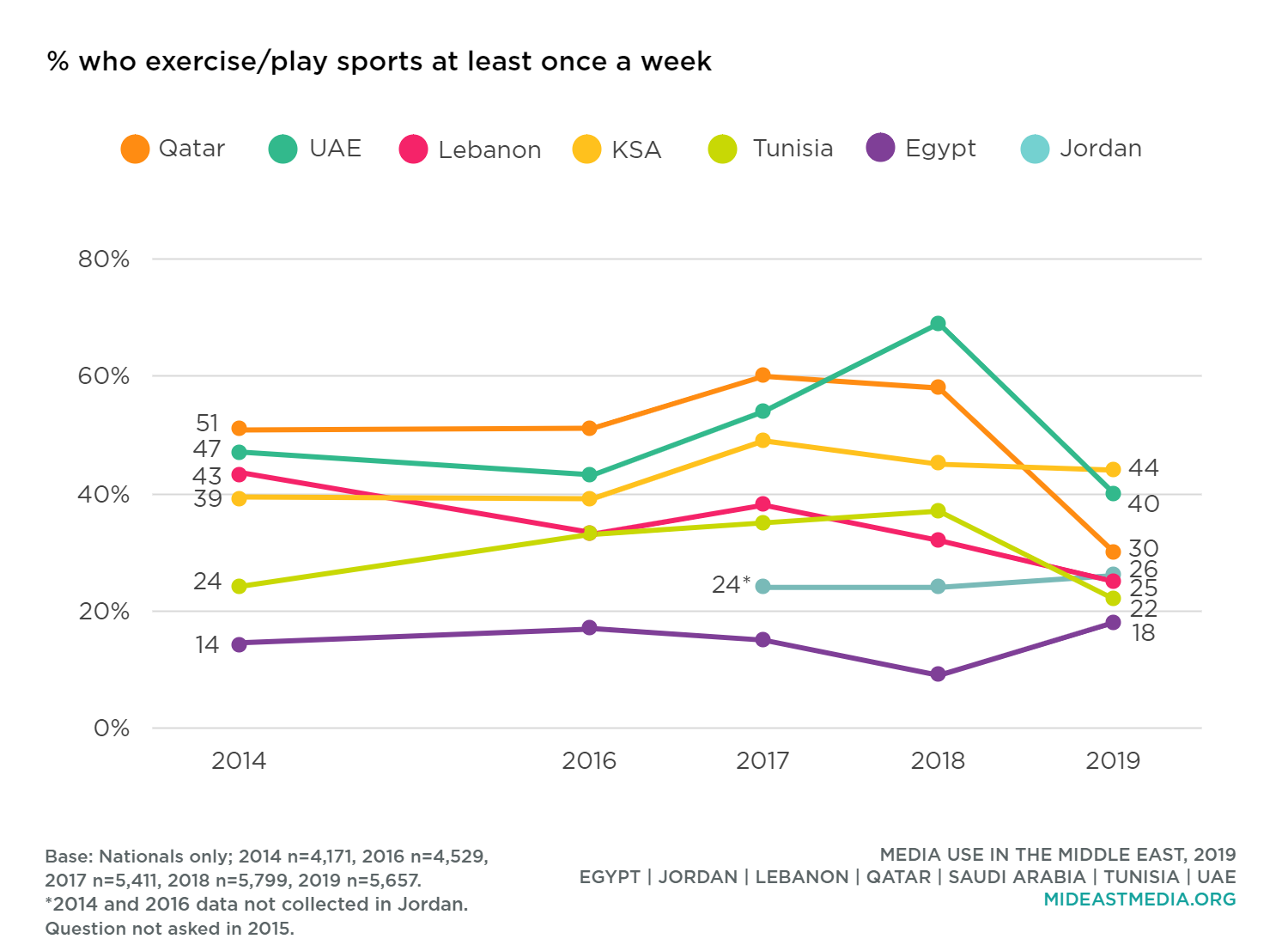

Exercising or playing sports at least once a week is routine for less than half of nationals surveyed, from a high of four in 10 in Saudi Arabia and the UAE to a low of two in 10 in Egypt and Tunisia. On average, nationals who exercise or play sports average about seven hours per week, with little variation by country (Jordan: 9 hours, KSA: 9 hours, Tunisia: 8 hours, UAE: 8 hours, Lebanon: 8 hours, Egypt: 7 hours, Qatar: 7 hours).

Men are more than twice as likely as women to exercise or play sports weekly, and men who exercise spend slightly more time at it than women who do so (participate: 37% men vs. 17% women; average hours per week: 9 men vs. 7 women).

Weekly exercise and sports participation rates are higher in younger than older age groups (39% 18-24 year-olds, 34% 25-34 year-olds, 22% 35-44 year-olds, 10% 45+ year-olds). The average time spent exercising or playing sports per week, however, is fairly similar across age groups, among the active (9 hours 18-24 year-olds, 8 hours 25-34 year-olds, 7 hours 35-44 year-olds, 8 hours 45+ year-olds).

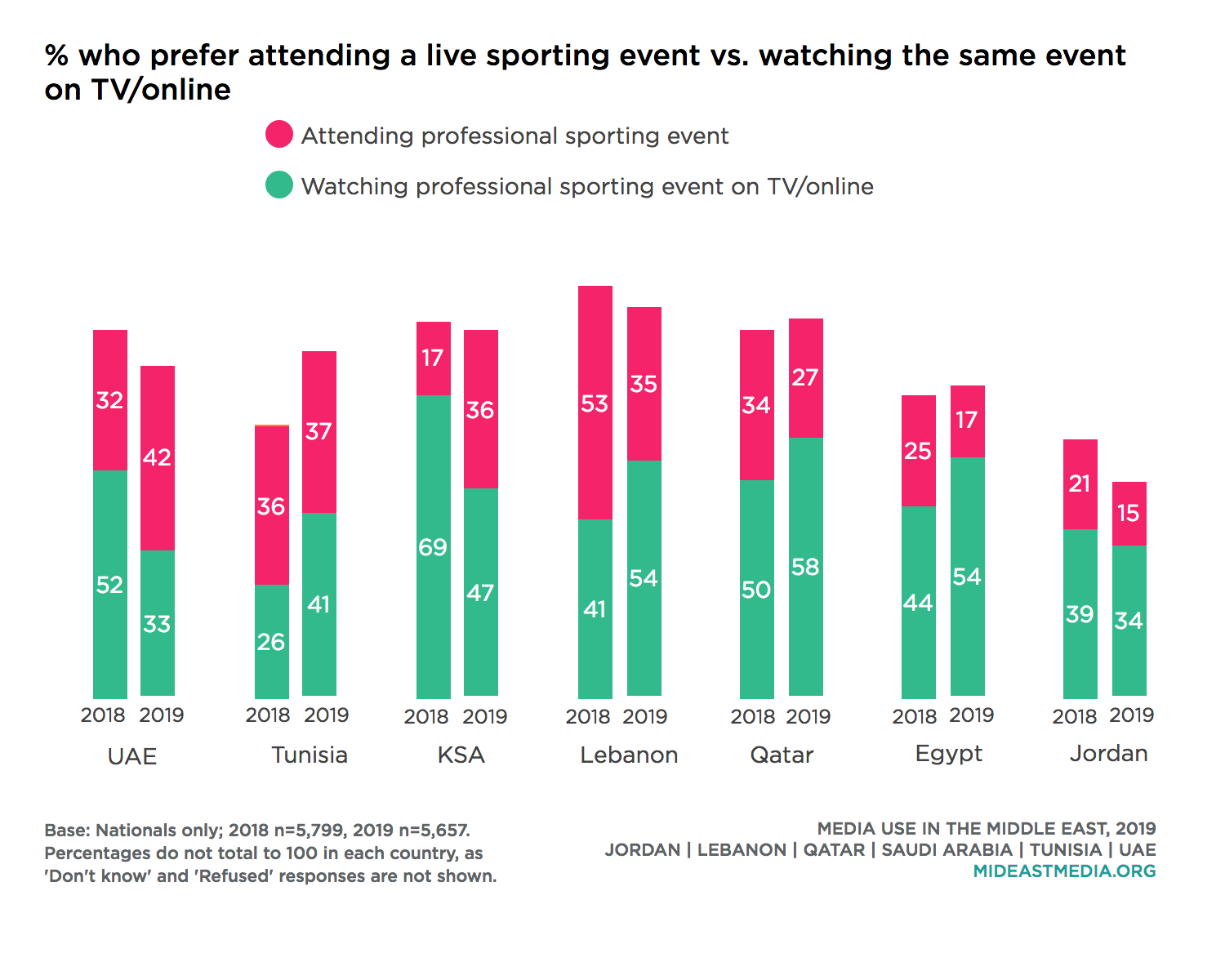

When given the choice of attending a nearby professional sporting event or watching it live on TV or digitally, the preference in all countries except the UAE is to watch the event on a screen rather than attend. Older respondents are even more likely to report a preference for watching on TV/online than attending (prefer to attend event: 39% 18-24 year-olds, 34% 25-34 year-olds, 24% 35-44 year-olds, 16% 45+ year-olds).